YouTuber-Backed ‘Bank’ Turned Sweepstakes Casino Yotta Has 85,000 Accounts Locked Up In Middleman Dispute

It's a YouTuber-backed fintech mess as the savings accounts are in limbo and the company now fashions itself as a sweepstakes casino.

5 min

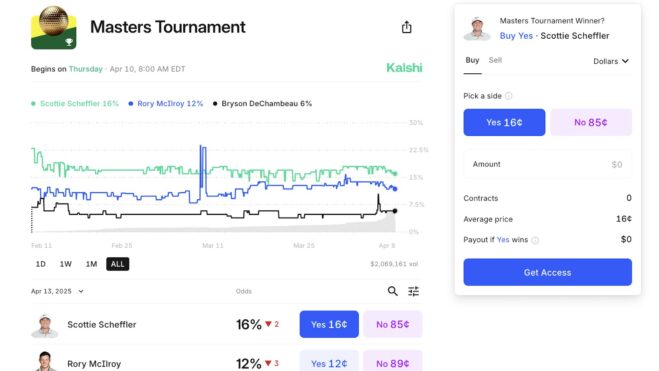

An app that was supposed to act as a bank to “gamify” savings and encourage sound financial decisions somehow found a way to turn into … a sweepstakes casino. Amid this pivot, Yotta’s customers, who have thousands of dollars deposited into their accounts, do not know when they will be able to access their money, a collective $112 million in savings. The Federal Deposit Insurance Corporation (FDIC) is now involved.

Yotta began as a prize-linked savings account (PLSA) app promoted by several influential finance YouTubers, or finfluencers. Many of their viewers opened accounts and used them for everyday expenses. Now, the company’s CEO Adam Moelis has said that 85,000 accounts have been locked amid a third-party dispute.

The reported cause for the disruption is a feud between fintech middleman Synapse, which has declared bankruptcy, and Tennessee-based Evolve Bank & Trust. According to Coffeezilla, a YouTube financial investigative reporter, a resolution likely won’t come anytime soon, leaving many customers’ financial futures in limbo.

The money is still in the accounts, to be sure. But customers cannot withdraw funds, nor can they deposit more into their accounts or make other transactions until the dispute is resolved.

“We never imagined something like this could happen,” Moelis said. “We worked with banks that are members of the FDIC. We never imagined a scenario like this could play out and that no regulator would step in and help.”

Yotta’s curious evolution

“A few years ago,” Coffeezilla recounts in a new video that has garnered 3.2 million views (and counting), “Yotta Savings advertised itself as a ‘no-lose lottery.'”

Customers would buy lottery tickets by depositing money into an account and saving it, as opposed to buying a product or service. The phenomenon is known to people in the fintech space as “gamified savings.” Some may also refer to it as “financial gamification.”

Yotta’s specific service known as a PLSA is not entirely novel and at one time in 2023 received praise from outlets including the New York Times. These accounts work like sweepstakes or lotteries. A user signs up and enters a contest. After a certain amount of time, sign-ups cease and a winner is drawn.

Coffeezilla said some YouTubers originally sponsored by Yotta Savings acquired equity in the company. One of the best-known YouTubers who gained an undisclosed equity position in the company was Graham Stephan.

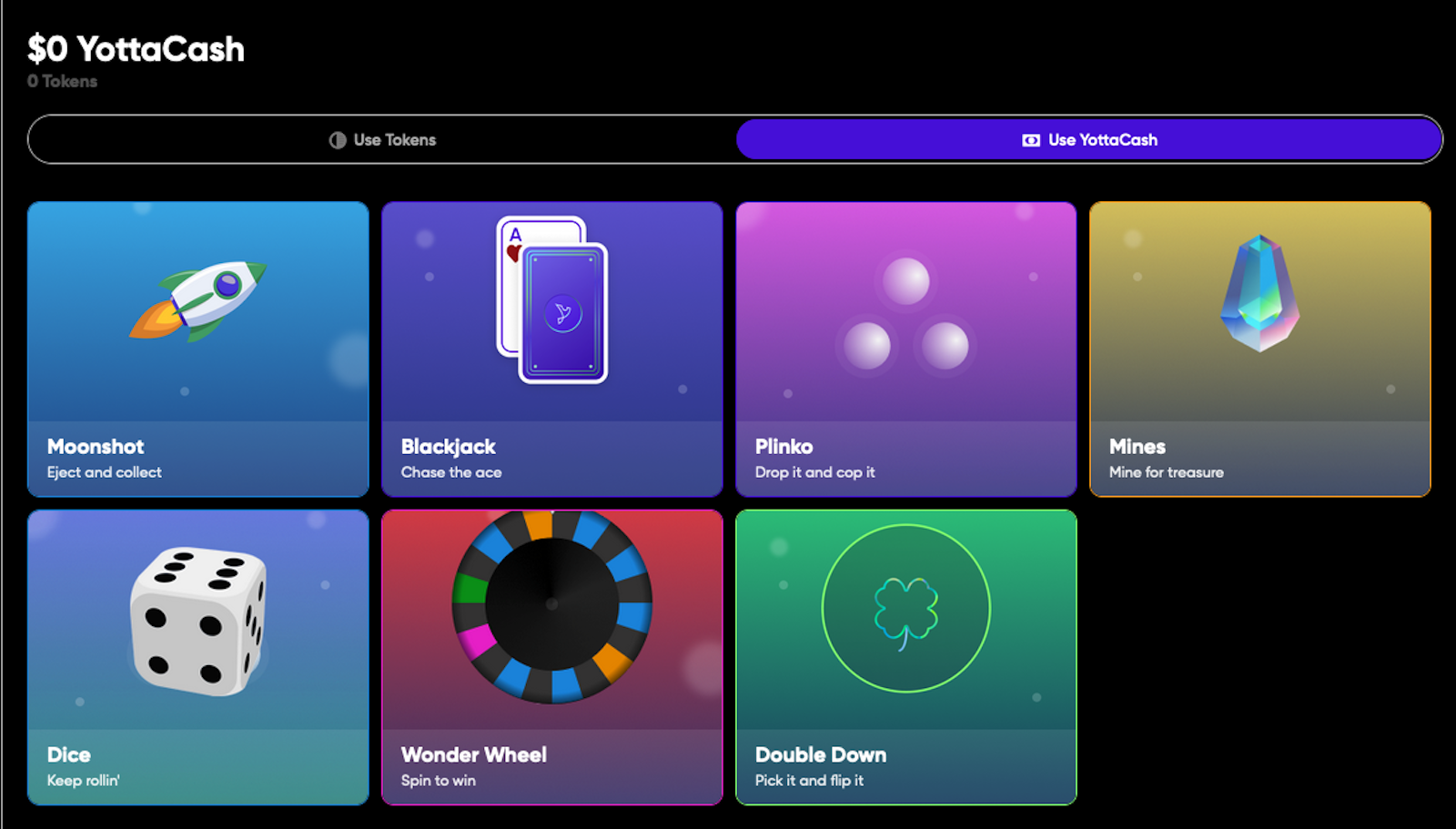

At the start of this year, Yotta fully shifted its app and business into a sweepstakes casino where users can buy Yotta Cash to play games including blackjack and dice. The “X” handle for @yottasavings no longer exists, replaced by @winwithyotta.

Moelis told Coffeezilla that he understands this goes against the original model that Yotta started with. That said, Moelis said the savings model wasn’t working, and the company needed to “pivot.” The pivot has caused several YouTubers to delete their videos tied to Yotta. Even Stephan removed his Yotta videos shortly after the locked-account situation began.

The start of the crisis

The crisis began on May 11, after Synapse declared bankruptcy. According to the filings, the company decided to cut access to a technology system that enabled lenders, including Evolve Bank & Trust, to process transactions and account information.

Banking reporter Hugh Son of CNBC wrote, “Synapse serves as a middle man between customer-facing fintech brands and FDIC-backed banks, but it has had disagreements with several of its partners about how much in customer balances it owed.”

The two sides are arguing about who owes whom and who is to blame for the funds being held back.

“The heart of the dispute between Synapse and Evolve Bank involves a foundational function of finance: keeping accurate ledgers of transactions and balances,” Son wrote. “Synapse and Evolve disagree on how much of Yotta’s funds are held at Evolve, and how much are held at other banks that Synapse worked with.”

Over the past year, most companies have decided to stop using Synapse for fear of it going bankrupt and the troubles it may cause. Ultimately, Yotta made the decision to stay with Synapse.

Casino Reports has reached out to Yotta for comment about the status of customer accounts and whether the company intends to offer PLSAs in the future with other partners, but Yotta had not responded as of press time.

Public perception

In an undated post on the Yotta website under the heading “Yotta Savings Account Rewards,” a message from Yotta to its users reads as follows:

Effective immediately, Yotta unfortunately has to discontinue paying rewards on savings balances, paychecks, and card spend.

The rest of the Yotta app, including your YottaCash as well as all of our games and prizes will continue to run as normal.

Why is Yotta making these changes?

This was not an easy decision to make. However, our primary vendor, Synapse Brokerage LLC, is no longer paying us the revenues we are owed on our deposits and cards.

Unfortunately, this means that we have no choice and can no longer offer rewards for these banking-related services.

What does this mean for me?

Effective immediately we will no longer award YottaCash APY on deposit balances and no longer offer Boxes.

Do I need to do anything?

We understand that this is not the experience you signed up for. If you would like to withdraw your funds now, you can do so via the Yotta app.

Please note, there is a $10,000 daily limit. If you have more than $10,000 in your account, you can reply to this email, and we will help facilitate your withdrawal above the limit. Alternatively, you can withdraw up to $10,000 per day until the full transfer is complete.

If you purchased I Bonds through Yotta you will receive an email from support@withyotta.com in the coming days with instructions to login to your Treasury Direct account where you can access your I Bonds. If you need any additional support accessing your Treasury Direct account simply reply to the email with instructions, and we will help you out.

Moelis, who has been in contact with other fintech principals impacted by the Synapse failure, estimated to CNBC that at least 200,000 customer accounts with balances are locked. While Synapse has said in court filings that it has 10 million end users, Moelis said it’s likely that the number of active accounts is far smaller.

Moelis told CNBC that he believes because of the relatively modest damage done and the fact that most Yotta customers aren’t wealthy, regulators are letting the dispute play out before intervening.

By contrast, regulators quickly intervened in the regional banking crisis that threatened the uninsured deposits of startups and rich families last year.

Customers who rely on these accounts to pay their bills, mortgages, groceries, and other living expenses don’t have time to wait. One customer told Coffeezilla that he couldn’t pay his rent since his account had been locked, and he could be evicted if the problem didn’t get resolved soon.

As Coffeezilla said in his video, these things do tend to get dragged out, leaving the little guy to suffer. That’s why he’s trying to bring this to a wider audience and help speed up the process if possible.

The path forward

Former FDIC Chair Jelena McWilliams was named trustee over Synapse. CNBC wrote: “Her job is to develop a plan to maintain Synapse systems and craft a solution ‘that allows funds to be returned to end users, to the rightful owners of those funds, as soon as humanly possible,’ said Judge Martin Barash.”

Moelis said he doesn’t care who wins the dispute; he just wants his customers’ accounts unlocked and their funds back.

“I don’t know who’s right or who’s wrong,” Moelis said. “We know how much money came into the system, and we are certain that that’s the correct number. The money doesn’t just disappear; it has to be somewhere.”