Texas Gambling Legalization Prospects For 2025 Looking Bright, Insiders Say

The politics remain tricky, but operators believe gaming expansion is ‘inevitable’

3 min

Texas has long demonstrated an aversion to legalized gaming, but there now appears to be momentum toward change. A panel of industry insiders and lobbyists at the Global Gaming Expo (G2E) in Las Vegas this week expressed optimism about the chances of passing gaming legislation in the Lone Star State — possibly as soon as the 2025 session.

The panel discussion, moderated by Tailored Hospitality Advisors principal David Rittvo, featured key figures from three major gaming operators: Cesar Fernandez of FanDuel, Andy Abboud of Las Vegas Sands, and Rick Limardo of MGM Resorts.

Abboud, who was notably optimistic, repeatedly emphasized that gaming expansion in Texas is “inevitable.” (It must be pointed out the Las Vegas Sands has been a major political donor in Texas, lobbying for casino legalization.) While Abboud acknowledged that the 2025 session may not bring the final breakthrough, he asserted that there has been significant positive movement. He pegged the chances of success at better than 50%.

Despite the growing optimism, the road to legalization remains complex. The process requires a constitutional amendment, enabling legislation, and, ultimately, approval through a statewide referendum.

Limardo highlighted that while progress has been made in the Texas House of Representatives, the Senate remains a significant hurdle. “We have to show this is viable in the Senate and get the votes there,” he said, acknowledging that they “don’t have the votes” at this stage.

Nevertheless, Fernandez emphasized that the majority of Texans are in favor of legalizing sports betting. Several polls, as Fernandez reiterated, shows voters have been warming up to legalized casinos and sports wagering. He projected that Texas could generate $250 million in revenue annually, as well as $1 billion in tax revenue within five years.

Illegal market thrives, other states reap benefits

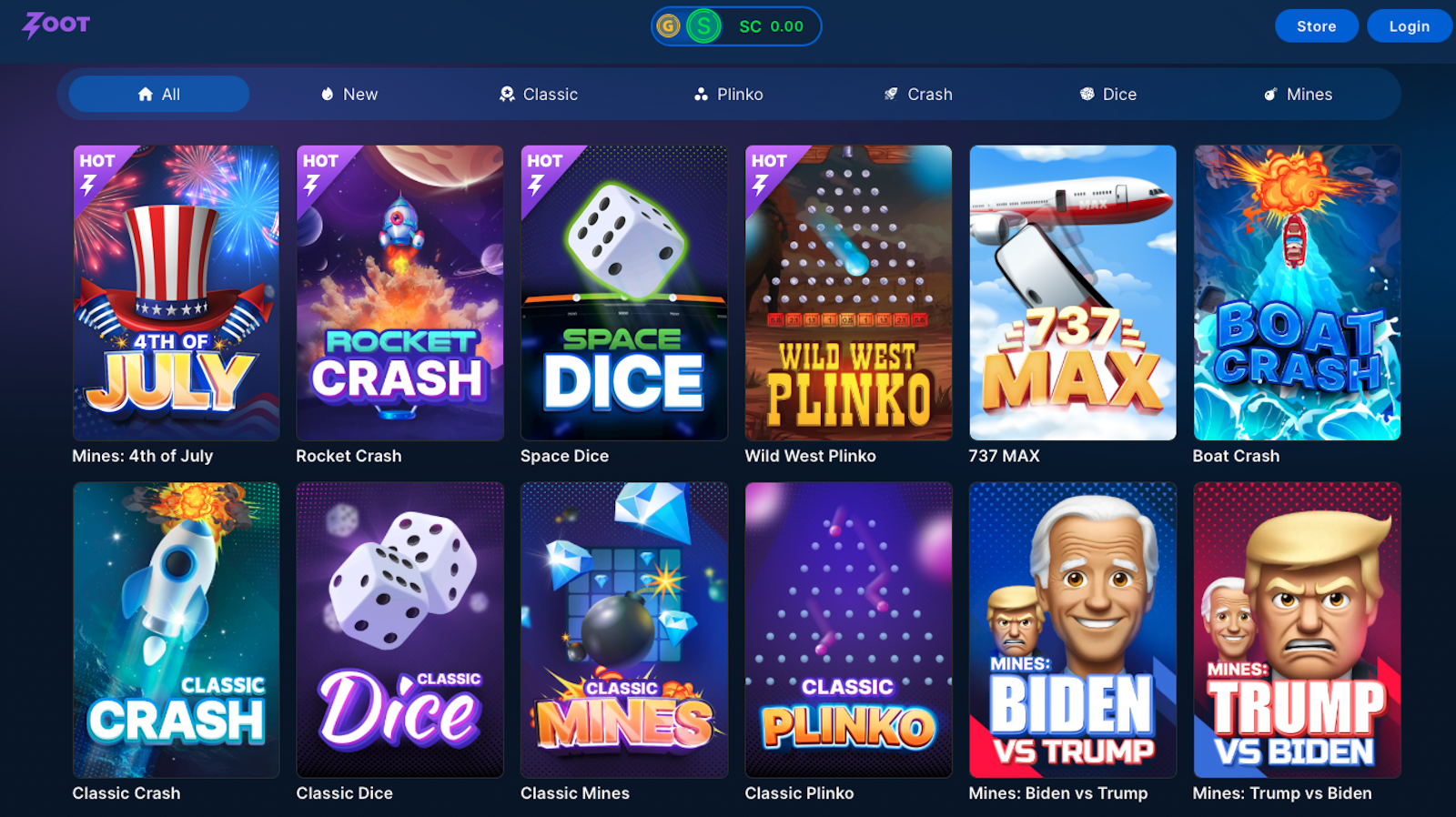

The panelists frequently referenced the size of Texas’ illegal gambling market. Abboud remarked that while Texas has the potential to become the largest legal gaming market in the U.S., it is already one of the biggest illegal markets. Fernandez cited data from Eilers & Krejcik Gaming that estimated that illegal sports betting in Texas might be producing around $7 billion annually without the state getting a cut of that.

Compounding the issue is the fact that Texans are already spending money on legal gaming — just not in Texas. Neighboring states have thriving gaming industries, which have benefitted enormously from Texas’ resistance to legalizing casinos and sports betting. Louisiana, for example, offers both retail casinos and legal online sports betting, attracting Texans who are willing to cross state lines to gamble legally.

“Voters see that money leaving the state and they’d like to see that return,” Abboud said.

Limardo also pointed out that local sports teams and racetracks are becoming increasingly aware of the potential economic benefits of keeping gaming dollars within the state. “There’s a lot of work to do with local stakeholders,” he said, stressing the importance of forming a united front in the push for legalization.

The lieutenant governor factor

Texas’ slow progress toward gaming legalization is often attributed to its unique political structure, specifically the role of Lt. Gov. Dan Patrick, who controls the Senate’s legislative agenda. Patrick, a staunch opponent of gaming expansion to this point, has long been viewed as a gatekeeper on the issue.

However, Abboud and the other panelists expressed hope that this may change if sufficient Senate support is garnered. Abboud confidently stated, “Once we swing them, [Patrick] will call for a vote.”

The outcome of the 2024 presidential election could also shift the political ecosystem in Texas. Patrick has close ties to the Republican Party and Donald Trump, and could be offered a cabinet position if Trump were to win. This would most likely — and quite significantly — alter the dynamics in the Texas Senate, potentially removing one of the largest barriers to gaming legislation.

A central message from the panelists was the distinction between legislative approval and public endorsement. Lawmakers would not be legalizing gaming themselves but rather giving Texas voters the right to decide. As Limardo pointed out, “Nobody’s ever lost an election for voting for a sports betting or casino bill,” hinting at the low political risk of putting the issue to a referendum.

Despite the optimism, panelists acknowledged that it’s not a sure bet that casino and sports betting legislation will pass in a single legislative session — it could be one or the other, or none. Abboud noted that discussions are ongoing about whether to prioritize one vertical — casinos or sports betting — over the other in the initial push. Given Texas’ long-standing opposition to almost all forms of gaming, such a staggered approach may be more palatable to both lawmakers and voters.