Schuetz: Let Me Give You A Tip — ‘No Tax On Tips’ Is Easier To Promise Than To Deliver

President Trump campaigned brilliantly on the issue in Nevada, but that may be as far it goes

7 min

“Even the Titanic Tipped”

— A note taped to a tip jar

President Donald Trump recently told the story of a “young waitress” coming up to him in Las Vegas who, in their conversation, complained she was not doing well because “ … they’re coming after me so viciously for tips.” The suggestion was that the IRS was on her case.

I have no idea if this story is true, but the fact that Trump was conversing with a “young” waitress probably adds credibility to it.

I also understand how aggressive the IRS can be about tips, especially when the target of the IRS’ investigation is not of the income level of those who show up to an audit with an accountant or lawyer. Table game dealers and other Nevada tip earners are easy targets to attack, as I’ve recently written about based on first-hand experience.

The topic of “no tax on tips” is nothing new, but the topic became important in Nevada during the last election. President Trump has suggested that his no-tax-on-tips pledge won Nevada’s six electoral votes for him.

In prior years, Ron Paul, a failed candidate for the Republican presidential nomination in 2012, authored a guest editorial in the Las Vegas Sun to make no tax on tips an issue, and that, like his candidacy, did not get much traction. There are other instances where this topic has surfaced only to burn out quickly.

Kamala Harris also had a no-tax-on-tips plank as part of her platform, but it never really caught fire. And that was the brilliance of Trump. Trump owned the topic, and he owned it because he focused on it in a state that has a vast and significant casino industry. And Trump knows about casino industry towns, for he used to have a material presence in Atlantic City. He even set the world record for casino bankruptcies there.

The left-pocket move

What is significant is that there are many jobs in Nevada, and Las Vegas in particular, where tips are an essential component of people’s income. This is not just about food servers as in some communities, but also doormen, bartenders, valet parkers, bell staff, beverage servers, table game dealers, hosts and hostesses, and on and on it goes.

Before I visit Las Vegas now, one of my tasks is to swing by my bank and grab a bunch of ones, fives, tens, and twenties. I never use or even have cash on me in Pennsylvania, but I would feel naked without it in Vegas. As we used to say when I lived and worked in Las Vegas, one has to be ready to make that “left-pocket move.” If you are going to move around Vegas and get what you want when you want it, you have to have a left-pocket move.

The left front pocket is where I keep my bankroll in Las Vegas and what I grab when I need to peel off a bill or two to handle this or that. There is also something of an art to how the bill(s) are held in the hand to be seen in a most inconspicuous style. The move has to be non-obvious, but sometimes, you want the potential recipient to be able to peek the denomination.

It used to embarrass my girlfriend, a lovely woman from Wisconsin, when I would make the left-pocket move. She was not accustomed to the culture of Vegas or of its people.

To prove that you can take the man out of Vegas, but not the Vegas out of the man, we were once at a Miami hotel and wanted to sit at the pool. It was a hot day, and an umbrella was not available. I handed the pool attendant a twenty, and he took someone else’s umbrella and umbrella stand and walked them over to us. As an aside, the umbrella stand was concrete, so it involved some effort. The people who lost the umbrella just sat in the sun, quizzically staring at us and the attendant, totally unclear about what had just happened. My girlfriend had never seen anything like that, for polite people from Wisconsin would not engage in such behavior.

Through time, however, she learned the power of a left-pocket move and developed one in her own style. Last year, she texted me with great joy when she and a friend were visiting London and she applied her version of the left-pocket move and got the best table for afternoon tea at the Ritz. And she peeked the denomination.

Same policy, different promotion

President Trump absolutely understood the tipping culture in Las Vegas. He also understood what a big deal no tax on tips was in a city built on tips. He mentioned it, embraced it, and sold it hard to the right audiences. This was his brilliance. Harris just kind of mentioned it. She was a California girl, and they don’t have much of a hint as to how Vegas rolls.

Moreover, because he was familiar with casinos, he knew the industry would be cool with it and not push back. It was a perfect win-win. The casino industry loves having someone else pay its employees, and if the employees can keep more of their tips, it is a big win for the industry. Plus, the paperwork on toke tracking and reporting is a massive pain in the ass.

Voilà, Trump wins six electoral votes.

What will be interesting to see is if he delivers on the campaign pledge. Should he not deliver, it may be because he had no intention of delivering, because, after all, he is not presently eligible to run for president again. It is not against the law for a politician not to fulfill a campaign promise, for if it were, all of our politicians would be locked up.

I believe Trump will give no tax on tips a try, but I sense that once they get into the details, what will survive is nothing or a very weak tea. I feel this because the details are a pain. The expression “no tax on tips” is straightforward and seems easy to say. It is not easy to do, for in tax policy, the devil is always in the details.

Practical analysis

EconoFact is a non-partisan publication that explores the facts and analyses of today’s relevant economic and public policy debates. Much of its efforts appear directed at presenting economic analyses that journalists can read and understand. I find it to be an impressive group of economists.

EconoFact recently looked into the issue of tax on tips and reached the following conclusions:

- The Harris Bill was much more detailed, allowing the tax on tips to be eliminated from income tax but not the payroll tax. This would have them continuing to contribute to Medicare and Social Security, offering protections for these individuals in later life. Trump has provided little details on his thinking, but many other Republicans in his camp have a smattering of bills, which are something of a hodge podge and often contradictory. This is why I believe that he may not be too serious about it, for he did not turn the wonks loose on it.

- The costs of these programs would be expensive. The best guess as to what researchers think Trump is suggesting (he has provided few details) would cost the country between $150 to 200 billion over the next decade. In other words, it would increase the deficit, ceteris paribus (economists like to use that expression, which means “all other things equal”) (really obnoxious economists make an effort to pronounce it in the Latin tradition). Anyway, a program that does not tax tips would be costly.

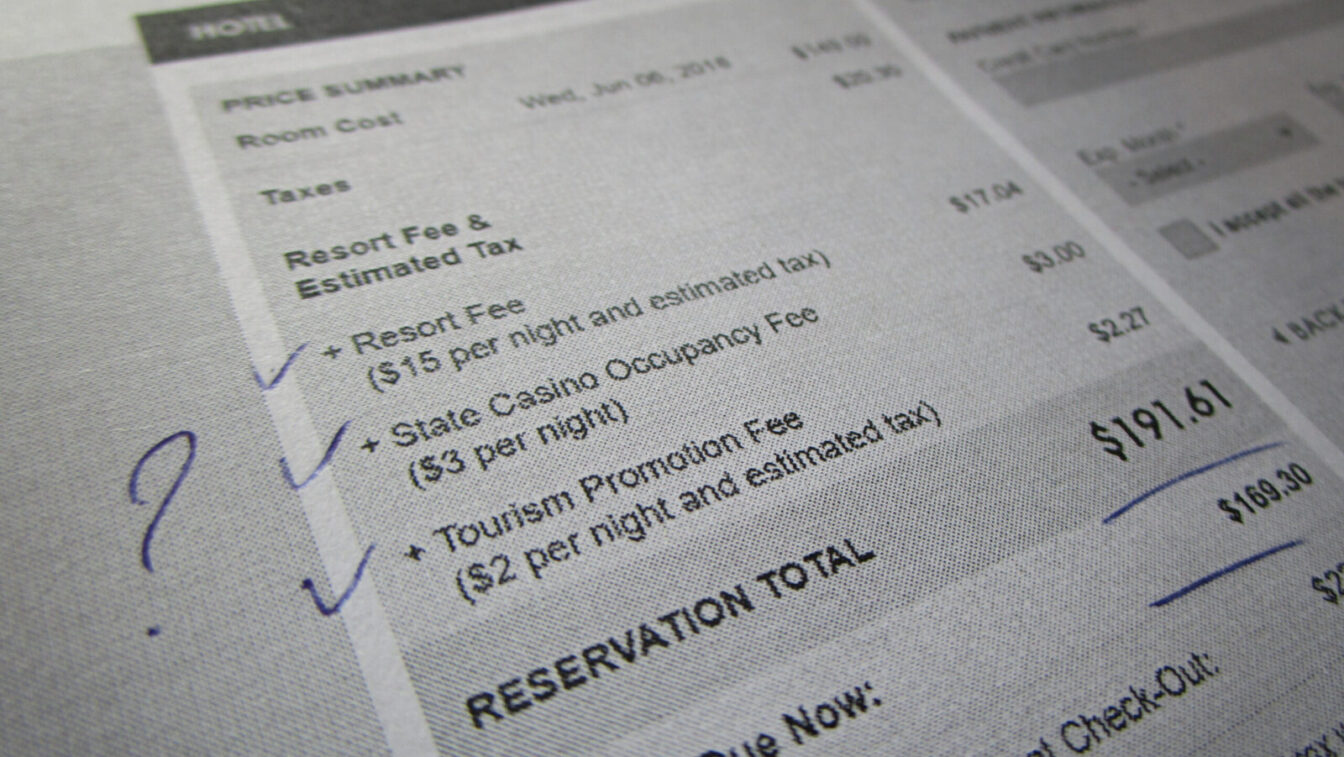

- There is also a concern about the behavior that a no-tax-on-tips bill would bring about. As mentioned by EconoFact, there is fear that people will work to turn their income into tips, such as a lawyer taking away a reward fee and calling it a tip.

The Tax Foundation is another non-partisan group with a reputation for simplicity, transparency, neutrality, and stability. It, too, has chimed in on the implications of no tax on tips. This is a fascinating read with realistic examples. Where it lands is best expressed by the title of the article: “Frustrated with Tipping, No Tax on Tips Could Make it Worse.” And their conclusion is, “No tax on tips might be a catchy idea on the campaign trail. But it could create plenty of headaches, from figuring out tips on previously untipped services to an unexpectedly large loss of federal revenue.”

Forbes Magazine has also looked at the issue of no tax on tips. It, too, suggests it is a bad idea, with the title, “No Tax on Tips: A Bad Idea With a Long History.”

The Forbes author refers to what he calls the effort by Trump and Harris to develop vote-buying schemes. This is a great and fun read, especially when Steve Rosenthal from the Urban-Brookings Tax Policy Center provided an excellent quote: “In tax policy, we evaluate proposed reforms by how well they promote equity, efficiency, and revenue.” He added that the “no taxes on tips solution fails all three tests.”

If you really want to get into this topic, there is also a great long-read from The Budget Lab, a product of Yale University. It is a very detailed and rigorous study by some incredibly sharp people. Two of my favorite economists are on the Board of Advisors. Especially impressive is that it lists pictures of the staff, the Board of Advisors, and their dogs.

As an aside, all three groups (okay, maybe not the dogs) seem to suggest this is a very complex issue that can cause many undesirable results. They are certainly not cheerleading the effort.

I bring all of this up because my guess is that what no tax on tips is really about was best stated by Joseph Thorndike in the Forbes article listed above, where he suggests that this was basically a vote-buying scheme by both Trump and Harris and once that cost and complexity is exposed, it will go nowhere. I believe that is the most likely result.

Oh, and please don’t blame the messenger when you have to keep paying taxes on tips.

—

Richard Schuetz entered the gaming industry working nights as a blackjack and dice dealer while attending college and has since served in many capacities within the industry, including operations, finance, and marketing. He has held senior executive positions up to and including CEO in jurisdictions across the United States, including the gaming markets of Las Vegas, Atlantic City, Reno/Tahoe, Laughlin, Minnesota, Mississippi, and Louisiana. In addition, he has consulted and taught around the globe and served as a member of the California Gambling Control Commission and executive director of the Bermuda Casino Gaming Commission. He also publishes extensively on gaming, gaming regulation, diversity, and gaming history. Schuetz is the CEO American Bettors’ Voice, a non-profit organization dedicated to giving sports bettors a seat at the table.