US Online Casino Data — Market Share By Brand, Gross Gaming Revenue Stats, And Taxation

Regularly updated U.S. iGaming data charts and insights

4 min

Which iGaming brand leads the regulated U.S. space in terms of market share, based on gross gaming revenue? How much tax revenue has each state’s regulated online casinos generated this year to date? And in which states are operators generating what kinds of revenue ?

This page is a living document, aimed at answering the questions above concerning online gambling statistics, and illustrating the contours and growth of the U.S. regulated online casino market through relevant online casino stats.

The charts and statistics below are presented by Casino Reports in collaboration with independent analyst Alfonso Straffon, a longtime industry observer, former sports trader, and equities analyst at Deutsche Bank. The charts will be updated on a monthly basis, on or about the third Thursday of each month, to reflect the latest state filing data.

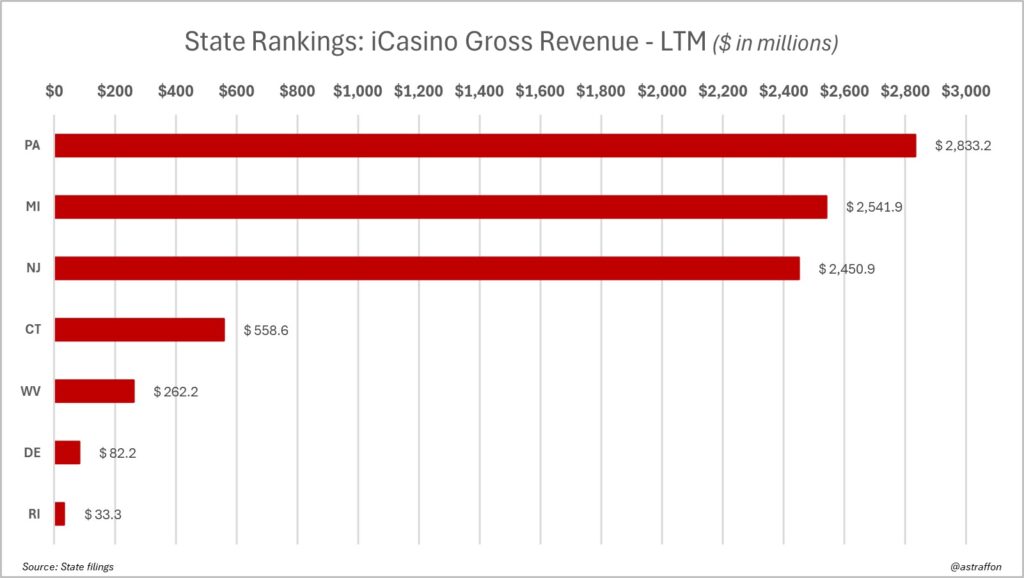

iCasino gross gaming revenue data, last twelve months (LTM) through January (2025)

Key Insights

- Pennsylvania leads the U.S. iCasino market; in the PA market, operators have generated $2.83 billion in gross gaming revenue over the last 12 months;

- Michigan and New Jersey closely follow, with $2.54 billion and $2.45 billion, respectively.

- Far behind but leading the second tier of states in iCasino revenue generation is Connecticut with $558.6 million.

- States like West Virginia and Delaware generate smaller but notable amounts, with $262.8 million and $82.2 million, respectively.

Michigan, New Jersey, and Pennsylvania have firmly established themselves as the “revenue triad” in the U.S. iGaming market, accounting for the highest gross gaming revenues in 2024. With each state generating over $2 billion, these three are the key centers of online casino activity, with major operators and suppliers like Playtech and Evolution Gaming setting up live dealer studios within their borders.

If or when New York joins the ranks — discussion is ever ongoing — the chart will probably show New York separating from the group, carving out an overall dominant position rather than joining to form a ‘four horsemen’ scenario. At least one lawmaker in New Jersey has floated the idea of amending its tax rate for both sports betting and iGaming, but the bill did not even attract a co-sponsor, meaning it’s not a priority or desirable position for anyone right now.

Note that in Delaware, at the end of 2023, the state lottery replaced the brand 888 with Rush Street Interactive to power its online sports betting and iGaming. In September 2024, Rush Street launched live dealer games through Evolution Gaming, available through all three of the state’s licensed casinos.

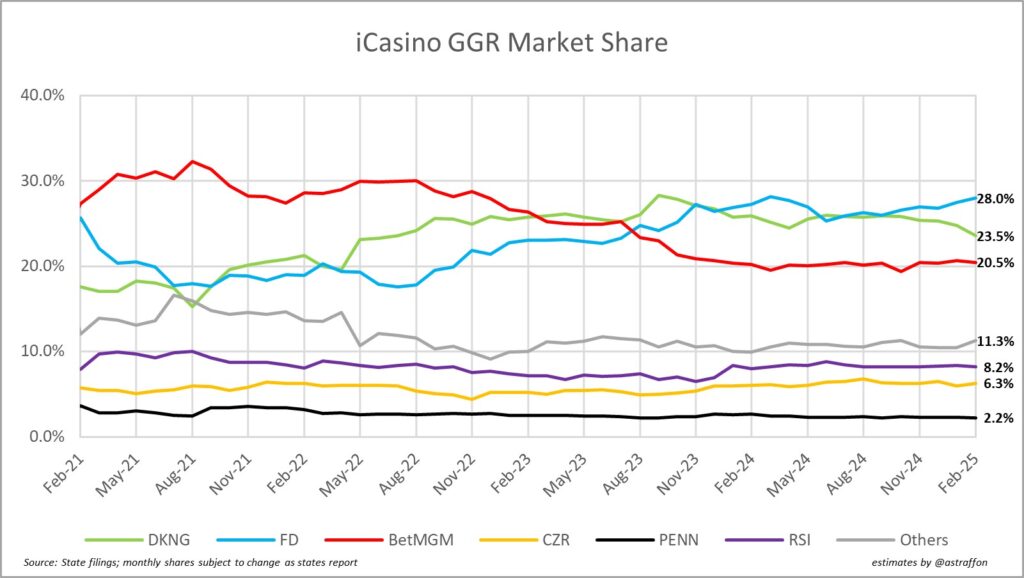

iCasino gross gaming revenue market share stats, January 2021 through January 2025

Key Insights

- FanDuel Casino and DraftKings Casino have each increased their market share by ~6%, mainly at the expense of BetMGM. And in late 2024, FanDuel took a slight edge nationally, which it has extended by nearly three points over DraftKings.

- In February 2025, FanDuel Casino went live with the exclusive Huff N’ More Puff, a digital version of the highly popular on-floor game.

- BetMGM’s market share has slipped from 30% to 20.5% since its post-launch phase in Michigan in 2021.

- Hard Rock is currently encompassed within the “Other” grouping, but is hovering at about 2%; if or when the Seminoles push iGaming in Florida, maintaining a state monopoly there, it will immediately surge upwards and certainly warrant its own line/color in the chart.

- Rush Street Interactive remains stable at an 8.2% market share, amid frequent acquisition rumors.

One of the interesting trends captured in this chart is the roughly 6% share increase that both FanDuel Casino and DraftKings Casino have achieved over the past three years; the climb has come at the expense of BetMGM, which at one time in the post-launch phase in Michigan (January 2021) surged to a 30% share, then began an approximate 10-point descent to 19.3% at present.

Both DraftKings and FanDuel have continued to invest in their casino products and have expanded their content libraries. FanDuel Casino has been pushing customers all year toward its World of Wonka slots game while dabbling in other new and exclusive titles, and DraftKings is innovating with a form of peer-to-peer poker available in certain states through its casino app. Meanwhile, all along, Rush Street Interactive (which operates the brands BetRivers and PlaySugarHouse), a frequently rumored acquisition candidate, has held steady at approximately 8%.

Note: For purposes of this chart, revenues deriving from multiple brands affiliated with the same parent company were combined. For example, Flutter owns FanDuel and Pokerstars, which were combined and attributed to FanDuel; meanwhile DraftKings owns and operates Golden Nugget Online Gaming as well as Jackpocket Casino, and likewise for BetMGM and Borgata.

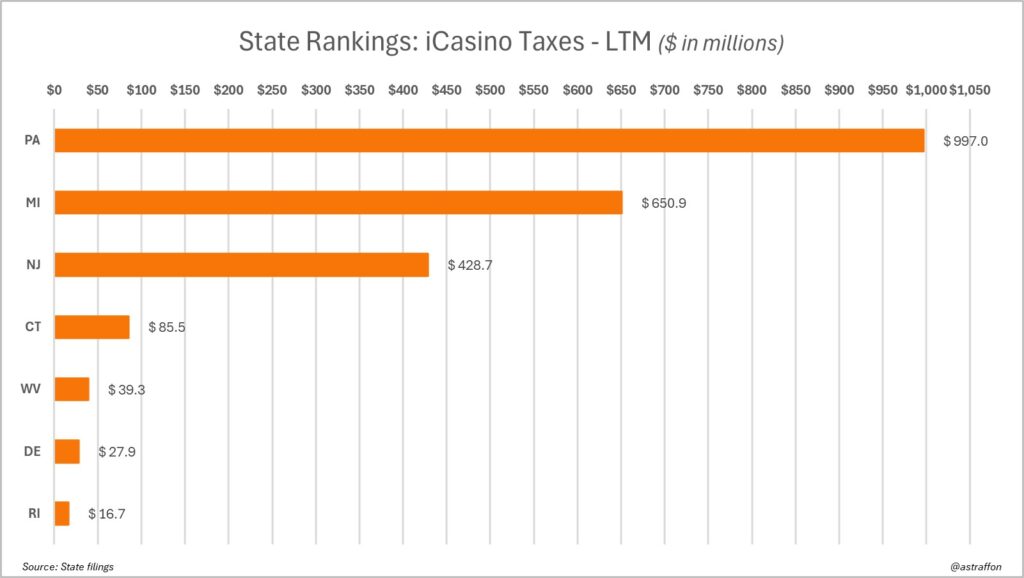

iGaming taxes generated, last twelve months (LTM) through January (2025)

Key Insights

- Pennsylvania leads with $997 million in tax revenue from iGaming operations, driven by high tax rates on slot machine games.

- Michigan follows with $650.9 million, benefiting from a robust market and from its graduated tax rate, which increases to 28% for the larger operators.

- New Jersey generated $428.7 million in tax revenue, largely due to its relatively modest 17.5% effective rate on iGaming. Of course this may rise in 2025 following Governor Phil Murphy’s budget address in which he outlined plans to push the online sports betting and iCasino tax rates to 25% GGR.

- Connecticut leads smaller states with $85.5 million, followed by West Virginia at $39.3million, Delaware at $27.9 million, and Rhode Island at $16.7 million, highlighting their lower tax revenues compared to the top three states.

This chart taken together with the iGaming GGR figures reveal that Michigan and New Jersey have become the most profitable states for operators, owing mainly to more modest applicable tax rates. Michigan applies a graduated rate that increases to 28% of adjusted gross revenue when an operator’s revenue exceeds $12 million; meanwhile in New Jersey, the number is a 17.5% effective rate on internet gaming revenue.

Pennsylvania’s tax on sports betting revenue is 36%, while the rate is variable on casino games — 16% on poker, 16% on non-peer-to-peer table games like blackjack, and 54% on slot machine games.

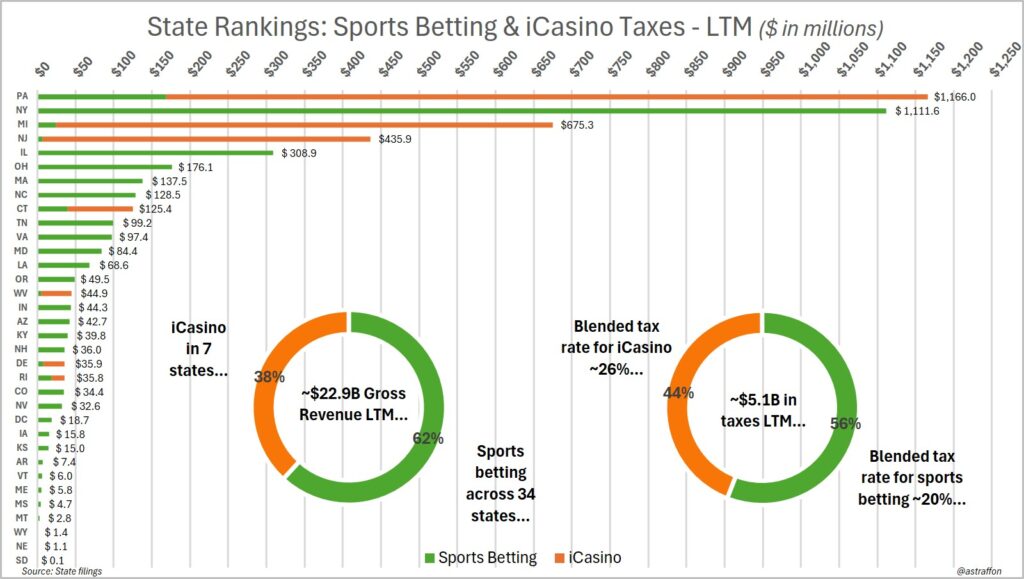

Sports betting and iCasino taxes data combined, last twelve months through (2025)

Key Insights

- That is not a typo — New York has almost matched Pennsylvania with sports betting tax revenue alone.

- If or when New York does legalize iGaming, the chart will need to be modified to accommodate the discrepancy in bar sizes.

- The juxtaposition of sports betting and iGaming tax revenues reveals the underlying reality that margins are higher and more stable for online casinos, even in the era of a rising structured hold percentage in sports and heavy parlay betting.

Important figures to note here: New York levies a nation-leading 51% tax on gross sports betting revenue on its nine active operators (DraftKings, FanDuel, Caesars, BetMGM, Fanatics, ESPN Bet, Resorts World Bet, Bally Bet, and BetRivers). Due to the monthly betting volume in New York that hovers between $1.5 and $2 billion, New York is nearly matching Pennsylvania’s revenue generation from iGaming and sports betting combined.