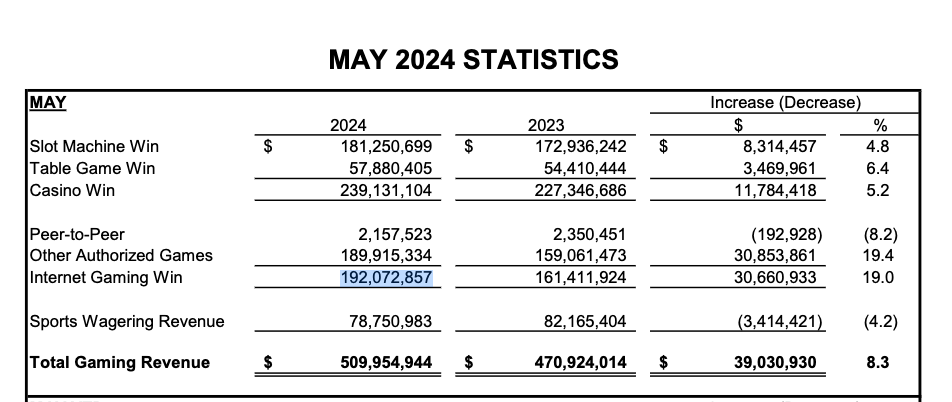

New Jersey’s May iGaming Revenue Hits $192M, Up 19% YoY

The strong numbers mean that the first half of 2024 - which already is at $942.8 million - will be the first six-month period with more than $1 billion in combined revenue for iGaming operators.

3 min

New Jersey online casino operators in May continued on their metronome-like pace – which in this case, clearly is a good thing for their bottom lines.

The collective $192.1 million in revenue for the month marks the fifth straight time that that figure has ranged between $182.2 million and $197.2 million – with a rise in revenue of 20.6% compared to the same five-month period in 2023.

The strong numbers mean that the first half of 2024 – which already is at $942.8 million – will be the first six-month period with more than $1 billion in combined revenue for iGaming operators since the state launched the legal, regulated gambling in November 2013. In fact, June might well wind up as the first $200 million month in Garden State history.

Golden Nugget ($54.5 million), Resorts Digital ($49.3 million), and Borgata ($44 million) together claimed the lion’s share of the May revenue. Golden Nugget enjoys partnerships with FanDuel, BetRivers, Betway, and JackpocketCity.com as well as having its own branded online casino site. Resorts is allied with DraftKings, newcomer ESPNBet, Mohegan Sun, and Pokerstars to supplement its website. BetMGM, and Borgata’s same-named online skin bring most of the revenue to Borgata.

Via NJ DGE

While Tropicana at $16.7 million and Ocean Casino at $6.9 million aren’t exactly worthy competitors to “The Big 3,” both doubled their online casino revenue compared to May 2023. Hard Rock ($10.3 million), meanwhile, was up more than 80% over a year earlier, another indicator that all nine Atlantic City casinos have room for more growth in iGaming dollars.

While the state has collected $143.7 million from online casino operators so far in 2024, lawmakers in 43 other states have yet to approve such gambling.

New Jersey sportsbooks sluggish in May; retail casinos fare better

Not even significant playoff runs by the region’s New York Rangers and New York Knicks could prevent a dip in wagering in May. At “only” $839 million, it marks the first sub-$1 billion monthly handle since the summer of 2023.

The hold percentage for the sportsbooks in May was a routine 8.6%, but the lesser handle sent revenue down by almost 5% compared to May 2023.

January 2024, as comparison, produced about double the betting handle at $1.72 billion and more than double the revenue at $170.1 million.

Who were the “biggest losers” among New Jersey sportsbooks in May?

That would be Caesars – which somehow lost $371.8 million for the month – and Resorts, which dropped $56.3 million. The duo had combined for almost $316 million in revenue the previous May.

However, the Resorts Digital side more than made up for the other losses, with DraftKings, ESPNBet, and other partners claiming $22.1 million for the month.

But the biggest winner was the Meadowlands Racetrack – led by its partner FanDuel – at $38.3 million in May revenue. That accounted for about half of the industry’s total in May, but it was down slightly from a year earlier as the lack of wagering volume could not quite be overcome.

Multi-leg parlay wagers – which seem to be more heavily advertised than ever – produced a 20% return for the sportsbooks, which casual gamblers would be wise to notice. Baseball and basketball bets, on the other hand, yielded modest profits of between 3% and 4%.

The news was better for the nine brick-and-mortar casinos, which were up 5.2% in May to $239.1 million. Even so, it’s possible that monthly online casino revenue finally outdoes the traditional version of the gambling, given current trends.

Hard Rock accounted for virtually all of the gained revenue, rising almost 30% to $49.9 million. The other eight casinos split evenly between gains of under $10 million or modest losses.

Overall, sports betting has brought the state $65.4 million in tax revenue in 2024 – with more than 95% of that coming from mobile wagers. Casino gaming overall has produced $212.9 million – with two-thirds of that coming from online casino play thanks to a tax rate that is roughly double what retail casinos pay on their revenue.

Tax matters

The combined online gambling tax revenue this year is $206.9 million. Freshman state Sen. John “Jack” McKeon introduced a bill earlier this year that proposed doubling the online gambling tax rate to 30% – still leaving the “cut” lower than neighboring New York and Pennsylvania.

But the bill has yet to be heard in the State Government, Wagering, and Tourism Committee for which McKeon serves as vice chairman, and that committee’s hearing scheduled for Monday, June 17 lists 10 bills – with the gaming tax hike bill not being one of them.

Lawmakers only have seven more days of legislative activity scheduled before they began their summer-long break after June 28, so nervous gaming industry observers worried that New Jersey could lead a tidal wave of tax hikes nationwide likely can breathe a sigh of relief – for now.

Ohio and Illinois already have passed major gambling tax hikes in 2024, but New Jersey doesn’t yet appear to ready to follow suit.

McKeon’s bill – S3064 – has yet to attract a single co-sponsor, another hint that it hasn’t gained traction at the statehouse in Trenton.