A poll released by Fairleigh Dickinson University on Friday shows that a particular topic has created an across-the-board consensus among New Jerseyan respondents: a distaste for the volume of gambling advertising.

That means that it could become part of a platform for candidates of either or both major political parties ahead of what could be a tossup gubernatorial race this fall.

“If either party is looking for a slam dunk issue in New Jersey, this is it,” said Dan Cassino, a professor of government and politics at FDU who also serves as the executive director of the poll. “Even the groups most likely to take part in gambling, like young men, seem to be fed up with all the ads.”

The specific question directed to almost 1,500 registered voters in the last week of February was: “There is concern about the number of ads for sports betting and other kinds of gambling in New Jersey, especially when those ads are seen by children. Would you support or oppose limits on where and when ads for betting and gambling could be shown in New Jersey?”

Democrats showed the most opposition — 81% to 14% — while participants who identified in the poll as “Black” showed the least opposition at 68% to 24%. Every other group support a ban at an amount from 70% to 79% except for Independent voters, whose opposition checked in at 69% to 21%.

There was only a single-digit shift across race, gender, age, and political parties – a rarity in polling.

That fact was underscored by the other question in this FDU poll, which queried the same residents about their sentiments about banning cell phones in schools. Men, Republicans, and White voters all support a ban by a margin of 8 to 18 points, while most other groups oppose the idea. A firm 65% of senior citizens support the idea of a ban, while only 23% of those under age 30 agree.

The mention in the question of a potential impact by gambling ads on children may have played a role in the level of support for an advertising ban.

A Seton Hall University poll from 12 months earlier had asked New Jersey residents if “There are too many sports betting related ads shown during sporting events.”

With that language, the agreement was just 47% versus 43% — although “avid fans” agreed by a 2-to-1 margin (60-30) that there are too many ads during games.

The Seton Hall poll followed up, however, asking if “sports betting advertisements improperly expose minors to gambling.”

In that context, 57% agreed — notably, up five points from the same poll and question in 2023.

Ban on smoking ads dates back more than a half-century

While the federal government banned tobacco advertising on television way back in 1970, Camel brand owner R.J. Reynolds created controversy beginning in 1988 with its ubiquitous “Joe Camel” marketing campaign in print media, on billboards, and on clothing. The threat of litigation and further governmental intervention – as well as a rise in Camel’s market share among young smokers – led the company to end the campaign in 1997.

The parallel in gambling advertising could be the slew of “risk free” and “can’t lose” TV commercial ads, most of which have been phased out in recent years, as well as the aggressive promotion of multi-leg parlays with poor odds. Young, naive viewers could be easy prey for such marketing, even with the legal gambling age in most states being age 21.

There is no similar nationwide ban on alcohol advertising, but the industry has avoided that fate precisely because it has self-imposed strict limits on such marketing.

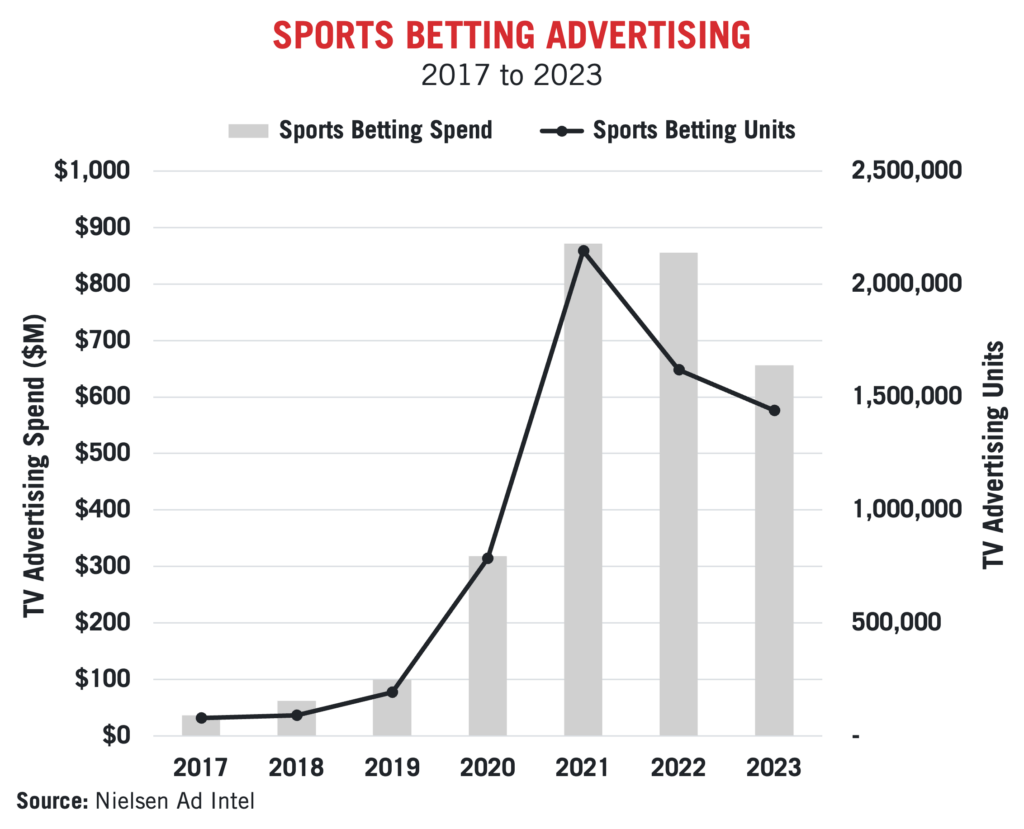

Meanwhile, the American Gaming Association, the nation’s leading casino industry trade association, has flagged a decrease in in sports betting advertising from 2017 through 2023.

The group reported:

- Total advertising spend related to sports betting (including DFS) declined $210 million compared to 2022, a 15% decline. Excluding DFS, sports betting ad spending was down 21% from 2022.

- Sports betting ad volume was down 4% year-over-year across all channels, having contracted 20% from the 2021 peak.

- Advertising volume across TV — the largest category for sports-betting advertisers — declined more — 11% — and has decreased 33% since 2021.

Nevertheless, the polls indicate that perception is what it is. And if gambling companies can’t reach their own consensus on self-regulation of TV advertising in the next year or so, they may risk meeting the same fate at the hands of federal lawmakers as cigarette manufacturers.