Commercial Gambling Industry Achieves National Revenue Record In Q1, AGA Reports

The whole pie keeps growing, but no sector is doing so faster than iGaming, which produced $1.98B in revenue in Q1, a 26.1% increase.

1 min

For a 13th consecutive quarter — in other words, every quarter since the harshly COVID-impacted 2020 year ended — U.S. commercial gaming revenue increased, the American Gaming Association shared Thursday morning in reporting its figures for Q1 of 2024.

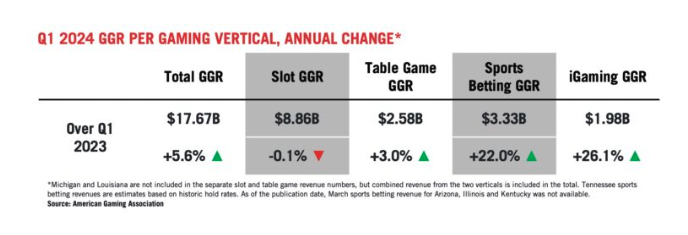

The top-line number: Gross gaming revenue (GGR) for the months of January-March came in at $17.67 billion, a new record for the commercial gaming industry, with March revenue of $6.09 billion the second-highest single-month figure ever, behind only December 2023.

According to the AGA’s Commercial Gaming Revenue Tracker, that total GGR represented a 5.6% increase over Q1 2023.

“While gaming’s momentum remains strong, 2024 will be the new baseline for future growth after several years of sports betting legalization and post-pandemic consumer shifts,” AGA President and CEO Bill Miller said in a press release. “Gaming’s continued growth relies on maintaining our commitment to innovation and responsibility.”

Online outpacing B&M

The whole pie keeps growing, but no sector is doing so faster than iGaming, which produced $1.98 billion in revenue in Q1, a 26.1% year-over-year increase.

Each of the six states that regulated iCasino prior to 2024 — New Jersey, Pennsylvania, Michigan, Delaware, West Virginia, and Connecticut — set quarterly revenue records in Q1. Rhode Island went live in March, chipping in $1.2 million in GGR in its first partial month.

Sports betting is growing almost as rapidly as online casino, with national revenue up 22% year-over-year to $3.33 billion. With four new markets (Kentucky, Maine, North Carolina mobile, and Vermont) launched since Q1 2023, betting handle reached $36.86 billion in the quarter, up 23.3% YOY.

Growth in “traditional” brick-and-mortar casino gaming was much more modest — but there was still growth. Severe January weather in some regional markets had a negative effect, but revenue was still up 0.3%, to $12.34 billion. $8.86 billion of that came from slots (down 0.1%), while $2.58 billion was from table games (up 3%).

An all-time single-month land-based casino gaming revenue record was established in March, when slots and table games nationwide combined for $4.46 billion.

Online gaming — meaning iCasino, online poker, and online sports betting — accounted for a record 29.3% share of total commercial GGR in Q1.

State-by-state rankings

The AGA broke down all revenue for the quarter by state, revealing an interesting top 10 in GGR:

- Nevada, $3.9 billion

- Pennsylvania, $1.7 billion

- New Jersey, $1.5 billion

- New York, $1.3 billion

- Michigan, $1 billion

- Ohio, $840 million

- Indiana, $724 million

- Louisiana, $700 million

- Maryland, $659 million

- Mississippi, $622 million

Taxes collected in Q1 reached a record nationally, with commercial operators paying an estimated $3.8 billion in taxes tied directly to gaming revenue, up 4.4% over Q1 2023.

The AGA also released its annual “State of the States” report Thursday, highlighting that 30 of 36 commercial gaming states set full-year revenue records in 2023.