Louisiana And Ohio Sports Betting Tax Rate Measures Highlight Divisive Fiscal Sentiment

A Louisiana bill that would have raised the betting tax has been shelved, while a new bill in Ohio aims to cut the rate

2 min

Two recent legislative moves tied to sports betting tax rates show that there’s still no common ground on what makes sense to states. On Wednesday, Louisiana moved to drop its attempted sports betting tax hike, and one day earlier, an Ohio state senator advocated for his state to cut its tax rate significantly.

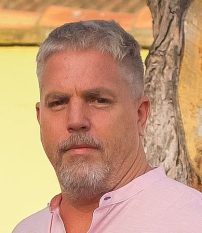

Louisiana Rep. Roger Wilder’s proposal to dramatically raise the state’s tax on online sports betting revenue from 15% to 51% has been dropped. The decision came following intense opposition from the state’s gambling industry.

House Bill 22, which was part of a larger tax reform package backed by Gov. Jeff Landry, was projected to increase state revenue by $151 million, according to an analysis by the Legislative Fiscal Office. Wilder’s proposal, which would have contributed to offsetting revenue losses due to a flat state income tax, had bipartisan support but faced strong resistance from Louisiana’s casinos.

At a hearing of the Louisiana House Ways and Means Committee on Wednesday, Wilder requested that the bill be deferred. He indicated that while he would continue working on the legislation, it is unlikely to resurface in the current special session ending Nov. 25.

The significant tax hike was intended to capture more revenue from the growing online betting industry in Louisiana, which, like many states, has benefited from a new tax revenue stream following the 2018 U.S. Supreme Court ruling that allowed sports betting to expand nationwide.

Opponents of Wilder’s bill argued that a 51% tax rate could stifle the industry’s growth. They added that this would likely discourage larger sportsbooks from expanding in Louisiana or investing in local operations.

Wilder, however, pointed out that the increase could help stabilize state finances, arguing that the proposed tax rate would bring in much-needed revenue without impacting individual income tax rates. For now, however, the recommendation won’t advance.

Ohio seeks betting tax breaks

While Louisiana lawmakers were grappling with the possibility of raising taxes on sports betting, Ohio is moving in the opposite direction. In 2022, Ohio lawmakers set a tax rate of 10% for sports betting. But in 2023, that rate was raised to 20%, a change initially supported by Gov. Mike DeWine as part of the state’s budget for the 2024-2025 fiscal cycle.

The rate hike is expected to bring in an additional $100 million to $135 million in sports gaming tax receipts annually. In Ohio, 98% of sports betting tax revenue is allocated to education and the remaining 2% goes to the Problem Sports Gaming Fund, which addresses gambling addiction issues.

Despite the expected increased revenue, Ohio state Sen. Niraj Antani, who originally helped legalize sports betting in the state, is now advocating for a reduction back to the original 10% rate. Antani submitted written testimony to Ohio’s Senate Finance Committee on Tuesday, asserting that the 20% rate has made Ohio’s sports gaming tax one of the highest in the nation, and arguing that this places Ohio at a competitive disadvantage compared to neighboring states like Kentucky, Michigan, Indiana, and West Virginia.

In his testimony, Antani argued that the higher tax rate places unnecessary financial pressure on smaller sports betting platforms, which may lack the resources of larger companies to absorb the tax hike. By returning the tax rate to 10%, he believes Ohio would find a balance that allows the industry to thrive while maintaining steady tax revenue.

Antani even expressed a preference for a 6.75% rate, which would make Ohio’s tax rate one of the lowest in the nation, tying with states like Iowa and Nevada. However, he noted that the 10% rate is a more realistic compromise, one that would encourage growth and competitiveness in Ohio’s sports betting market without risking a significant loss in revenue.

The bill is still open and awaiting comments.