Kindred Reiterates Unibet Exit Strategies In The US, Sets Departure Dates

Kindred Group continues to move closer to its planned exit from the North American market, curtailing operations in several states.

2 min

Kindred Group has had difficulty gaining traction in North America with its Unibet online betting and casino brand. It recently announced a strategic withdrawal of the company from the U.S. and Canada, and continues to offer more details about its ongoing transition.

The exit strategy includes a halt of Unibet’s operations in New Jersey, with a set departure date of May 14, according to a message on the Unibet site. This decision is part of a broader initiative to refocus on its core markets and implement cost reduction measures.

Leading up to this, Unibet has already taken steps to wind down its services, including the removal on March 11 of all progressive jackpot games in New Jersey. This was followed by the discontinuation of fund deposits on April 5. Customers will retain access to their accounts until May 1, however, allowing them to use any remaining funds or bonuses.

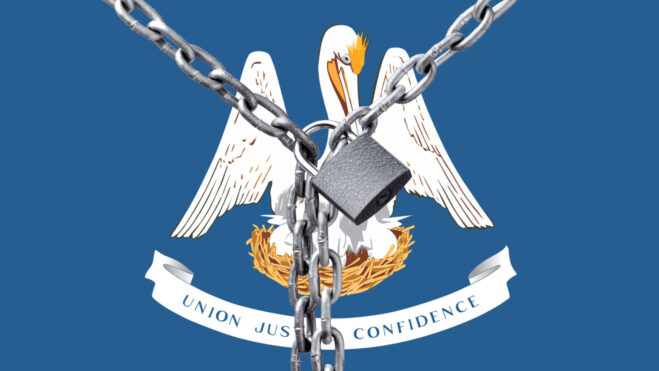

The withdrawal from New Jersey accompanies a similar exit from the Pennsylvania market, where Unibet will cease operations on June 21. These moves are indicative of Kindred’s strategic shift and a response to the challenges faced in these markets.

Despite efforts to establish a presence in these states, Unibet struggled to capture substantial market share, which has been reflected in its financial performance. In the third quarter of last year, Kindred reported a year-over-year revenue decrease of 11% in North America. With those results, it incurred losses amounting to over $21.6 million. Cumulative losses since the first quarter of 2021 surpassed $93 million.

The company has expressed intentions to concentrate on markets where it sees a clearer path to increasing its market share. This refocusing aims to leverage Kindred’s strengths in its established markets, such as the U.K., Scandinavia, and France.

A new kind of Kindred

This restructuring is a part of Kindred’s broader cost reduction initiative. This, the company has said, is both necessary and decisive for its long-term growth and sustainability. Kindred, according to a previous press release on the company’s planned exit, anticipates that the exit will result in the reduction of approximately 300 North American jobs. As a result, it should expect an annual cost saving of around $50 million.

In parallel with these market exits, Kindred has initiated a strategic review process to explore various alternatives to maximize shareholder value. This review includes the consideration of a potential sale of the company, either wholly or partially, or other strategic transactions.

A potential suitor has already emerged. This past January, as the Wall Street Journal initially reported, La Française des Jeux (FDJ), a major French lottery and gaming organization, proposed a substantial offer to acquire Kindred Group.

The offer, valued at around $2.67 billion, has been recommended by Kindred’s board to its shareholders for acceptance. This acquisition could potentially reshape the landscape of the European gaming market, creating one of the largest online gambling entities. The deal reflects the growing consolidation trend in the industry. It also highlights the strategic value that companies like Kindred hold in the expanding global online betting market.

FDJ has become a strong online gaming operator, growing significantly over the past couple of years. It recently took over management of the Irish Lottery and is at the center of a controversial plan that would see it control the French online gaming space exclusively.