Kalshi Users Create $198 Million In Contracts For First Two Rounds Of NCAA Tournament

First two rounds with few upsets does little to dampen enthusiasm on Robinhood-powered platform

2 min

Editor’s Note: An earlier version of this story stated that the dollar figure for contracts traded was $249 million, which reflected the “total series volume” shown on Kalshi’s website at the time. Kalshi subsequently updated that figure to indicate $194 million. It is now $198 million at the time of this writing.

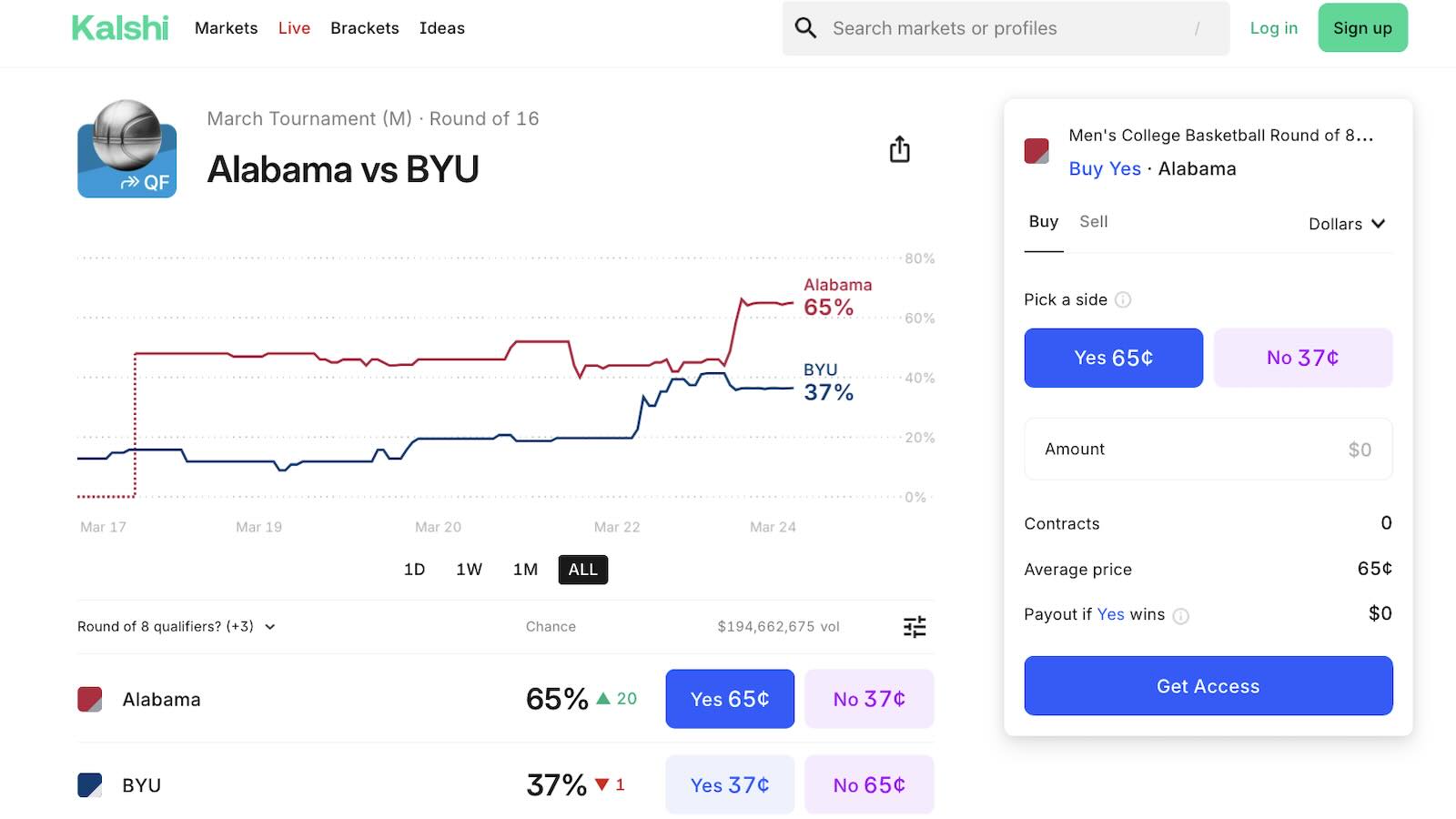

Kalshi’s sports betting prediction market has proven to be a huge hit as it is currently reporting $198 million worth of contracts created on the Robinhood-partnered platform following the first two rounds of the NCAA College Basketball Tournament.

Its website currently lists Duke as the favorite to win the tournament, offering a buy Yes/No price of 30 cents/72 cents. Fellow No. 1 seeds Florida and Houston rank second and third, respectively. Florida’s buy is 19/82, while Houston has a 16/85 buy.

As perspective, the state of Kansas reported $252.9 million handle for March 2024, which ranked 19th out of 33 states with commercial sports betting. North Carolina, which launched regulated sportsbooks last March and benefited from North Carolina State’s surprising run to the Final Four as a No. 11 seed, reported $659.3 million worth of wagers accepted in its first three weeks of activity. That figure, however, was also boosted by $202.6 million worth of promotional credits from mobile sportsbooks.

The $198 million figure is roughly 6.5% of the $3.1 billion the American Gaming Association estimated in legal wagering for the men’s and women’s NCAA Tournaments this year, an estimate that did not appear to contemplate the action that Kalshi customers across all 50 states might contribute. EKG estimated a $2.63 billion handle for college basketball’s signature event according to the Earnings + More Substack.

Either way, it is an impressive amount of activity given Kalshi and Robinhood announced only last Monday they would offer NCAA Tournament markets, one day before the First Four started in Dayton, Ohio.

Entering the RG market

The Event Horizon Substack on Monday is reporting Kalshi is also taking its first notable steps towards game integrity for sports betting and responsible gaming. It reports Kalshi will announce an integration partnership with IC 360 for game integrity. IC 360 is a technology firm that monitors suspicious activity for regulated sportsbooks, and in this instance will do the same for the trading of sports event contracts.

Included in the partnership with IC 360 is the use of ProhiBet, which has a primary purpose of preventing athletes, coaches, and any team employee from attempting to place a wager at sportsbooks, and now through Kalshi’s prediction markets.

The substack is reporting Kalshi will also soon unveil a “consumer protection hub” in which users will be able to self-exclude themselves, be able to remove themselves from the platform for a set amount of time, and set a maximum deposit limit.

Many of these features exist in regulated sports betting markets, with Kalshi showing some variation with its “trading breaks” option. It calls the ability to exclude themselves from trading on the platform “voluntary opt-outs,” while deposit limits are labeled “personalized funding caps.”

Kalshi continues to operate as an exchange platform, an entity registered with the Commodity Futures Trading Association (CFTC). The company’s foray into sports-based “event contracts,” or prediction markets, follows a judicial decision in the fall of 2024 that permitted the company to proceed with markets based on election outcomes.

From there, Kalshi and a competitor or peer in Crypto.com began to push the bounds of existing CFTC rules and regulations, starting into sports with a market on the Super Bowl. Menus have continued to expand since the end of 2024 and especially after the inauguration of President Donald Trump, whose eldest boy Donald Jr. was named as a special adviser to Kalshi.

The federal agency has announced roundtable discussions on sports-based prediction markets, currently expected to occur before the end of April. In advance of that, the agency has received a variety of stakeholder comments, many of them opposed or skeptical of quasi-sports betting blanketing the U.S., entirely bypassing state-based regulatory frameworks, some stakeholders have alleged.