Kalshi Granted Temporary Restraining Order And Preliminary Injunction In Nevada Dispute

Kalshi scores an early, important legal win in District Court in Nevada

2 min

United States District Court Judge Andrew P. Gordon on Tuesday issued a temporary restraining order and preliminary injunction from the bench in favor of Kalshi against the Nevada Gaming Control Board. The only caveat is that it was granted “in part,” according to the docket notes, as a written ruling will follow.

While that leaves some room for interpretation, appellate litigator Andrew Kim on ‘X’ opined that the “in part” likely refers to some time limitation, or perhaps some technicality about the TRO becoming moot. The written ruling will clarify but the point is, the decision marks an important legal victory for Kalshi in a question of federalism, state sovereignty, and federal preemption.

“Today, the Federal Court in Nevada granted Kalshi’s preliminary injunction and blocked the State from trying to prevent Kalshi from offering prediction markets,” said a Kalshi spokesperson, per Front Office Sports. “We are grateful for the court’s careful attention to this matter and recognition of Kalshi’s status as a CFTC-regulated exchange. On to the next step.”

Kalshi filed its lawsuit against the NGCB on March 28 after the state agency issued a cease-and-desist letter to the trading platform claiming it was violating state law in offering sporting-event contracts without a license.

Kalshi had filed its reply seeking both the temporary restraining order and preliminary injunction Monday against the NGCB. The trading platform’s primary arguments centered around its claim the state agency failed to address what Kalshi called the “statutory text showing the CFTC has ‘exclusive jurisdiction’ over trading on CFTC-regulated exchanges.”

The trading exchange platform, which filed a similar lawsuit against the Division of Gaming Enforcement in New Jersey, has also been served cease-and-desist letters from gaming regulatory agencies from Ohio, Illinois, Maryland, and Montana.

Kalshi also claimed the NGCB’s argument hinges on a “basic misunderstanding of Kalshi’s position.” The trading platform stated its position in the current appeal regarding political-event contracts being heard in the Washington D.C. Court of Appeals is “the same as here — that Congress left it to the CFTC, not 50 separate states, to decide whether Kalshi’s sports-event contracts should be authorized as comporting with the public interest.”

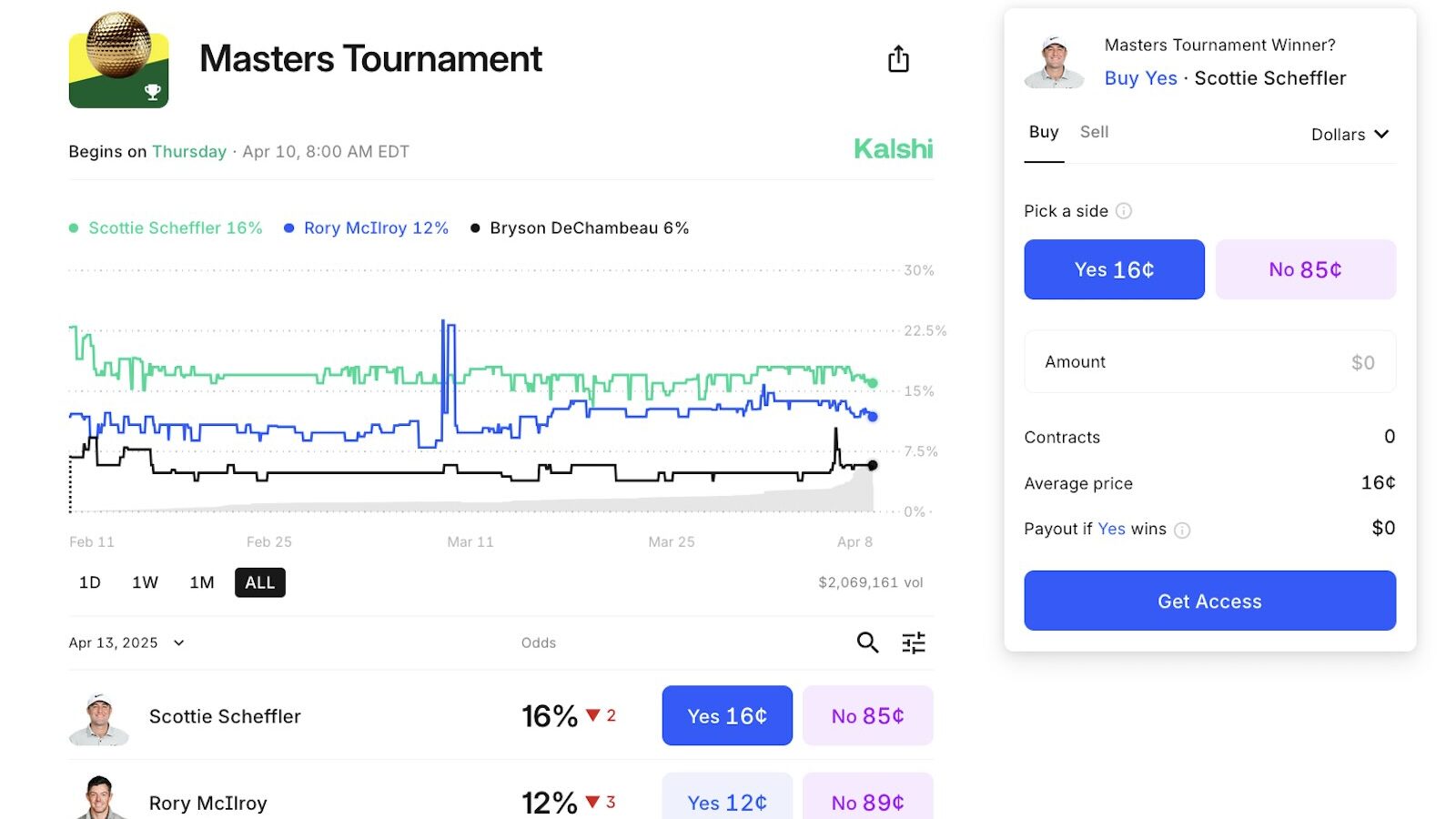

The last known figure for the worth of traded contracts for the recently completed men’s NCAA Tournament was $384 million as of Monday morning. Kalshi continues to offer contracts for multiple sporting events, including this week’s Masters golf tournament and eventual NBA and NHL champions.

Gordon also denied the NGCB’s countermotion and set a status hearing for April 30.

Kalshi: NGCB fails to make connection for preemption

Kalshi’s argument for needing a temporary restraining order and injunction starts with its stance the Commodities and Exchange Act (CEA) preempts Nevada state law pertaining to political-event contracts. While that is currently being debated in the U.S. Circuit Court of Appeals in the nation’s capital, Kalshi claims the NGCB and other defendants failed to attempt to explain how allowing states to ban such contracts could be consistent with the Supremacy Clause.

Kalshi took issue with the Defendants’ belief the trading platform is arguing “Congress’s grant of ‘exclusive jurisdiction’ to the CFTC preempts the ‘entire field of gaming laws.'” Kalshi claims the CEA prempts the field of “futures regulation on CFTC-designated contract markets,” which means state attempts to regulate contracts on CFTC-regulated markets are preempted, even if it is via state gaming laws.

Kalshi presented the argument gaming laws are preempted as applied to exchanges like Kalshi, which subject to the CFTC’s exclusive jurisdiction. It noted the Defendants “make no effort to grapple with the principle evidence of Congress’s intent, which is the text of the CEA to grant the CFTC said exclusive jurisdiction.”

A claim of ‘imminent harm’ following a cease-and-desist

Kalshi lastly claims the Defendants “cannot dispute the irreparable harm” caused should it follow the cease-and-desist letter. It offered precedent from previous cases backed by the Supreme Court in which similar types of plaintiffs faced “a Hobson’s choice: continually violate the [state] law and expose themselves to potentially huge liability,” or else “suffer the injury of obeying the law during the pendency of the proceedings and any further review.”

Kalshi listed four areas of potential harm: being subject to imminent criminal prosecution; the harm its users would suffer if existing trading positions were “paused” or “liquefied;” the imperiling of its CFTC desigantion; and what it claims would be “millions of dollars and reputational harm” it would incur without preliminary relief.