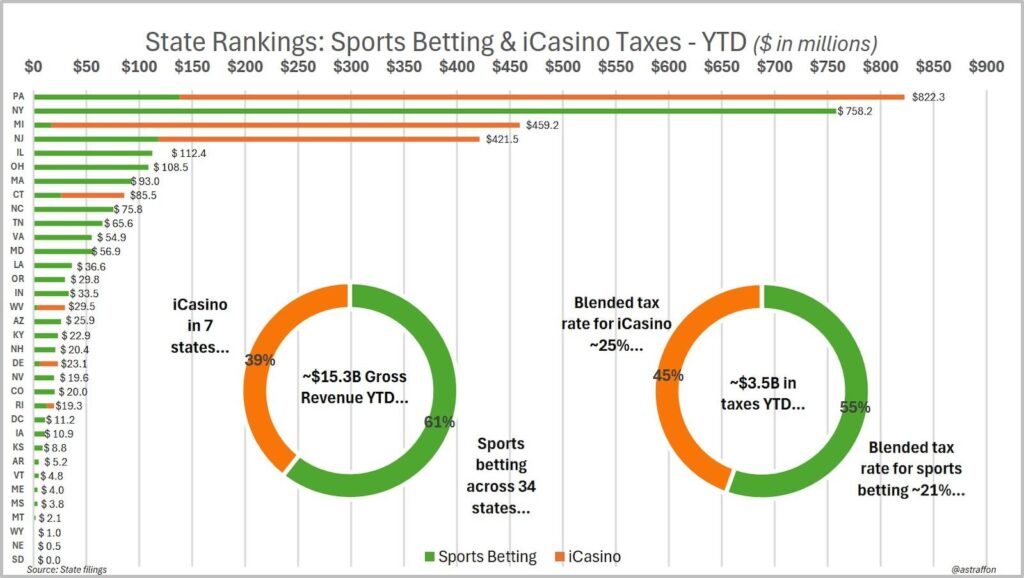

A Mere Seven iCasino States Generate 39% Of All iGaming Plus Sports Betting Operator GGR, And 45% Of Taxes

A record month in NJ factors into a pie that is increasingly orange despite a small footprint

1 min

You’ve got your bars, so how about some pie? That’s what’s on the menu today from the data laboratory of Alfonso Straffon, a former equities analyst for Deutsche Bank and longtime industry observer.

After updating the year-to-date database to include figures from the iGaming triumvirate of Michigan, New Jersey, and Pennsylvania, whose agencies all reported September data this week (including a new record in New Jersey), Straffon ran the numbers and layered on top a visualization indicating the proportion: i) operator gross revenue generated comparatively via regulated U.S. sports betting and iCasino; and ii) state taxes generated via the same.

The numbers, well, they mostly speak for themselves. Nevertheless…

Across seven casino states, the aforementioned triad of Michigan, New Jersey, and Pennsylvania plus four relatively small states, population and size-wise (with one exception), Connecticut, Delaware, Rhode Island, and West Virginia, are generating 39%, or $6.0 billion, of the aggregate $15.3 billion produced by regulated operators in the U.S. in 2024, in states where data is available. (Note that this omits Florida, where the Seminole Tribe controls most of the gaming industry, including its online sports betting monopoly in Hard Rock Bet, through its compact with the state.)

For the other circle, how does it all tabulate in the realm of taxes? iCasino registers an even greater 45%, or $1.6 billion, of the year-to-date taxes generated via both regulated sports betting and iGaming in 2024.

Meaning sports betting, applying a blended tax rate of ~21%, owing to disparate tax treatment across the various regulated jurisdictions, produced 55% or approximately $1.9 billion to date in 2024, with three months of reporting to come.

All of this is potentially a long way of underscoring the revenue and tax generation upside of iCasino, especially compared with sports betting.

Meanwhile, the tensions and fears around demand substitution (a.k.a. cannibalization) between brick-and-mortar-driven operations alongside digital and tech juggernauts, all of them ostensibly represented by the American Gaming Association, persist. All of this at a time when social casinos and social sportsbooks using sweepstakes models are sparking some combination of war declarations and lawfare.

For the most recent 2025 projections by columnist and collaborator Steve Ruddock, check the latest “Ruddock Report.”