Online Gaming A Gold Mine Of Untapped Tax Revenue, Vixio Report Says

If legalized in all states with other regulated gambling, tax revenue could reach $15B annually

2 min

The financial potential of iGaming in the U.S. is greater than most realize. According to a new report by Vixio, prepared for Light & Wonder, legalizing iGaming in every remaining gaming state could generate billions in additional tax revenue for state and tribal governments each year.

The U.S. commercial gaming industry is a massive market, with a total size of $66.66 billion in gross revenue in 2023, according to data from the American Gaming Association. Within this industry, iGaming holds significant potential.

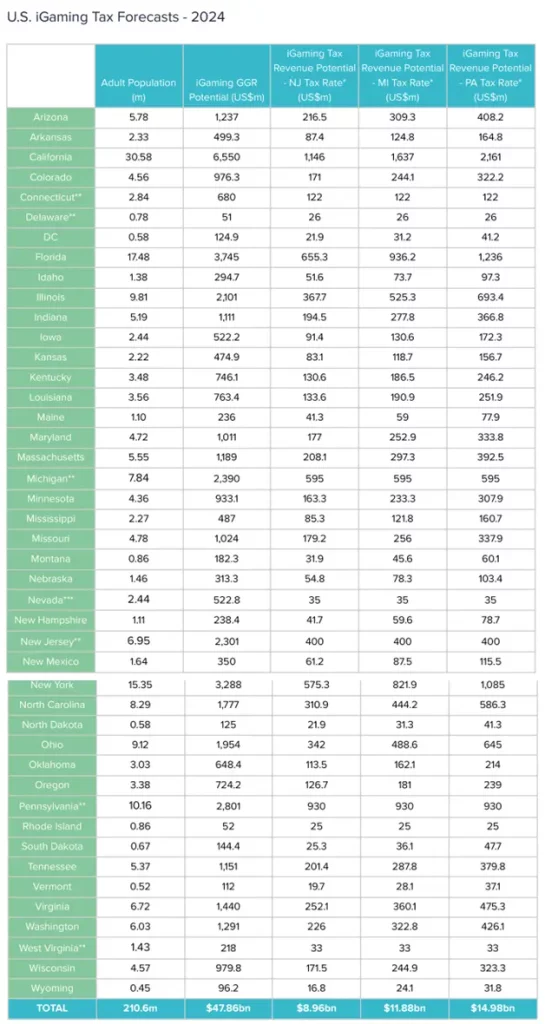

Vixio’s updated report, “U.S. iGaming State Tax Revenue Potential August 2024,” provides independent forecasts for the potential tax revenue that state governments could expect to earn if iGaming were legalized in each state that currently has either legal land-based casino gaming, online sports betting, or both. It’s an update to an initial report produced by Vixio and published by Light & Wonder in 2022, reflecting more recent revenue figures reported by state governments as well as alternative assumptions regarding the tax rates that future iGaming states may seek to apply.

Currently, online casino is legal in only seven states: Connecticut, Delaware, Michigan, New Jersey, Rhode Island, Pennsylvania, and West Virginia. Nevada permits online poker but not the full range of casino-style games.

Even with its limited footprint, online gaming delivered $1.61 billion in tax revenue last year.

The figure is particularly impressive when compared to commercial sports betting, which was legal in 29 states last year and generated $2.06 billion in tax revenue.

Should all 44 jurisdictions with some form of gambling legalize iGaming, Vixio predicts that state and local governments could see as much as $15 billion in combined tax revenue each year.

Key findings

- Current iGaming Revenue: In 2023, the six states where online casino games were legal generated $1.61 billion in direct gaming tax revenue for state and tribal governments.

- Potential iGaming Market Size: If iGaming were legalized in 44 states, the potential size of the U.S. iGaming market could reach $47.86 billion in annual revenue.

- Estimated Tax Revenue: Assuming a comparable effective tax rate to the state of Pennsylvania, legalizing iGaming in 44 states could generate an estimated annual tax revenue of $14.98 billion.

For the purposes of this report, iGaming is defined as the offering of virtual casino-style games, including slots and table games like blackjack and roulette. It does not include mobile sports betting.

Study methodology

The core of this study’s methodology lies in estimating iGaming revenue potential for each state by leveraging data from the seven established iGaming states. This process involved calculating the average trailing 12-month (TTM) iGaming gross revenue per adult in legal online gambling states.

Official revenue statistics reported by state regulatory agencies for the existing iGaming states were instrumental in this analysis. To help develop concrete results, Vixio focused on the period ending June 30, 2024.

To standardize the data, Vixio used the U.S. Census Bureau’s 2020 adult population figures to determine the number of adults in each state. The resulting TTM average revenue per adult across the established iGaming states was found to be $214.20, with noticeable variances:

- New Jersey: $306 per adult

- West Virginia: $134 per adult

- Connecticut: $167 per adult

- Michigan: $272 per adult

- Pennsylvania: $192 per adult

The study then applied the $214.20 average revenue per adult to the total number of adults over 18 years in each of the 37 potential iGaming states. For states with established iGaming sectors, such as Rhode Island, the analysis used forecasted revenue totals for 2024 to estimate tax revenue, adjusting for current market performance.

Crunching the numbers

For a more accurate analysis, certain adjustments were made. Delaware was excluded from the average revenue per adult figure due to its underperformance compared to other states, with just $41 per adult. Additionally, Rhode Island was not considered since its iGaming market was less than 12 months old at the time of the study.

In projecting iGaming tax revenue, different tax scenarios were considered. Specifically, the analysis applied tax rates equivalent to those in New Jersey, Michigan, and Pennsylvania to the forecasted revenues of the 37 potential new states.

Under these tax scenarios, the study estimates different potential tax revenues:

- 17.5% (New Jersey’s tax rate): $8.96 billion

- 25% (Michigan’s tax rate): $11.88 billion

- 33% (Pennsylvania’s tax rate): $14.98 billion

These findings suggest substantial revenue opportunities for states considering the legalization of iGaming, although specific tax policies will ultimately determine the exact figures.