Gray Market Slot-Style Games A Contentious Issue Among Regulated Casino Crowd

"How can you ask us to spend a half-billion dollars, then allow 50,000 gray market machines to be legalized?" Hard Rock CEO Jim Allen asked.

3 min

The American Gaming Association estimates that nearly 600,000 unregulated gambling machines — so-called “gray market” games that resemble slot machines but aren’t subject to state government oversight — exist in the U.S., compared to about 800,000 regulated slot machines.

With that kind of volume, it’s no wonder that the contentious topic came up on several occasions at last week’s East Coast Gaming Congress in Atlantic City, New Jersey.

Hard Rock CEO Jim Allen, whose casino hotel played host to the event, pointed to his temporary casino in Bristol, Virginia, that is scheduled to be replaced in July 2024 by a permanent $550 million facility with 750 guest rooms, almost 3,000 slot machines, and about 100 table games. Yet even as the company is investing so heavily in the state, a bill was moving forward in the Virginia statehouse to legalize gray market games across the state.

Allen said he has met with Gov. Glenn Youngkin on three separate occasions to express his concerns.

“How can you ask us to spend a half-billion dollars, then allow 50,000 gray market machines to be legalized?” Allen said he asked the governor.

Allen said the “good news” was that earlier this month, Youngkin announced his preference for a compromise that would ban the machines from any convenience store, tavern, or other business that is located within 35 miles of one of Virginia’s four casinos (a fifth is slated to open in Norfolk in 2025).

“But this issue will come around the corner again, and it’s very important in regional markets,” Allen added.

A swing state on multiple fronts

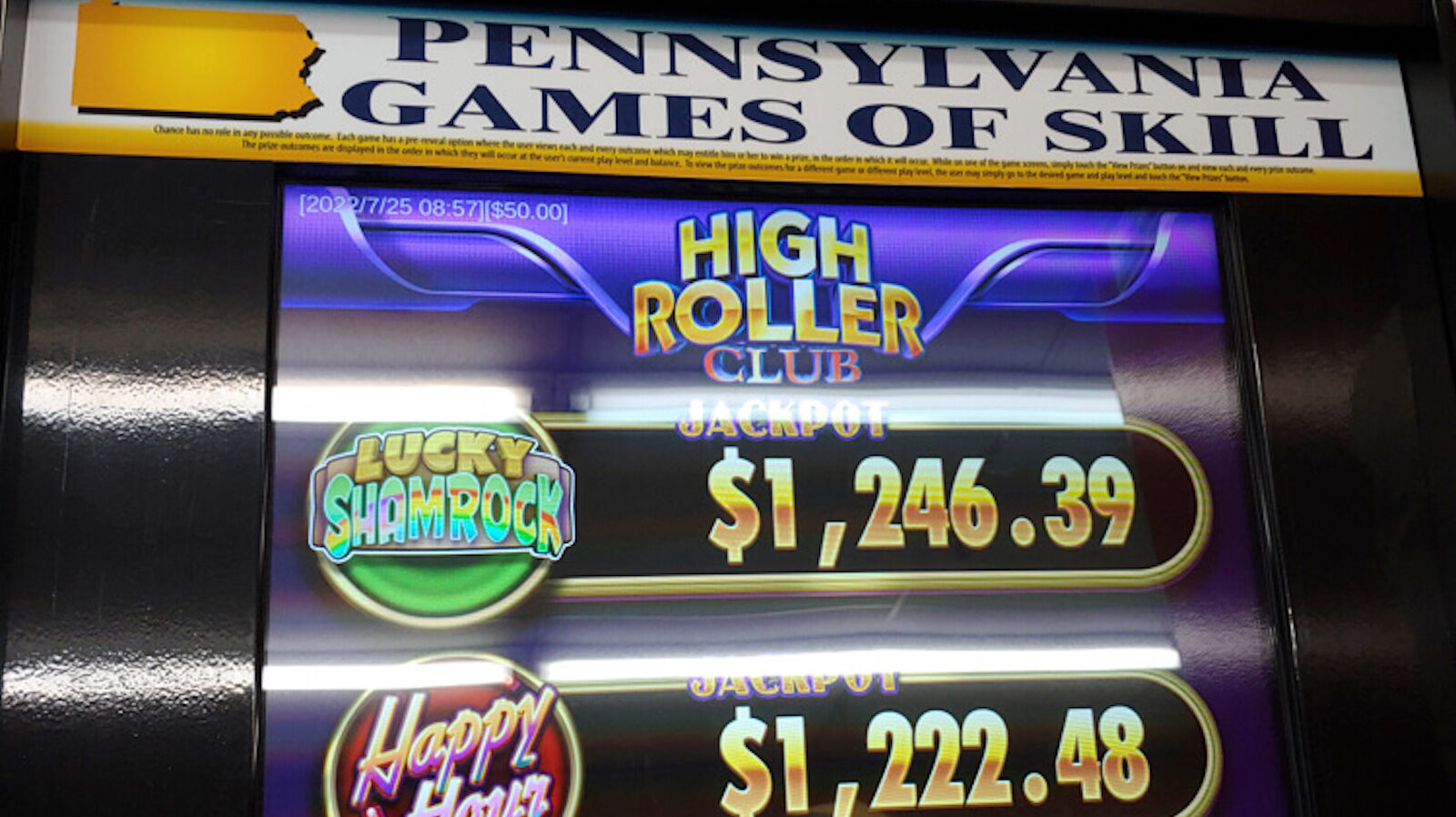

One of the core battlefront states in the gray market games controversy is Pennsylvania. Kevin O’Toole, the executive director of the Pennsylvania Gaming Control Board, told the audience that there are “at least 60,000” such machines in Pennsylvania. O’Toole noted that not only are they found in bars, taverns, and fast-food restaurants, there are even storefronts that offer consumers nothing but these games. If that number is correct, it exceeds the total number of regulated slot machines located at the state’s casinos.

Gov. Josh Shapiro in February expressed his support for legislation that would regulate the machines, which supporters insist are “skill-based” and thus not the same as slot machines. At a more recent legislative hearing, an official from industry leader Pace-O-Matic estimated the company had installed 18,000 machines in Pennsylvania.

So far the skill-game manufacturers have the upper hand, thanks to a 7-0 Commonwealth Court ruling last fall that concluded that the games are not illegal gambling devices as defined by state law. The state Supreme Court declined to take on one such case, O’Toole said, with a similar case still potentially pending before the court.

The ruling likely means that it would be up to the legislature to give clarity as to the legality or illegality of these unregulated machines. A bill introduced several weeks ago would cap the number of games at 30,000 across the state and limit them to private businesses that have liquor licenses or to social clubs — with no more than five machines at any single site. A tax of 54% proposed in the bill would mirror the levy on regulated slot machines at casinos.

O’Toole said it is “hard to project” what the final language of such a bill would look like after lawmakers debate the details.

PENN is not mightier

Jeff Morris, vice president of public affairs for PENN Entertainment — which operates three casinos in Pennsylvania and 40 more across 19 other states — said that the unregulated machines have proliferated in recent years as little to no legal resistance was mounted against the machines.

“Unfortunately, Pandora’s Box has been opened, and we sit at a point now where we’re going to have to address this,” Morris said. “The industry’s position is, if we’re going to [allow for gray market games], let’s do it properly. It needs to have tax parity. It needs to have regulatory parity. There needs to be responsible gaming rules, to protect players. For the brick-and-mortar casino gaming industry, having stability is imperative given the amount of money we have spent and the amount of jobs we have created.”

Morris also questioned whether gray market operators are sincere in their stated willingness to be placed under a traditional regulatory umbrella — as that would cut deeply into the profit margins of the companies given the projected tax rate.

Over in Virginia, hundreds of convenience store and gas station owners recently banded together and refused to sell lottery tickets — a major revenue generator in all 45 states where they operate — as a way to protest Youngkin’s compromise proposal of both the 35-mile casino radius ban and the 35% suggested tax rate on the gray market machines.

In response, Youngkin’s press secretary Christian Martinez said in a statement: “The governor supports small business owners having access to skill games and his proposed legislative amendments, stemming from discussions with a bipartisan group of members and dozens of outside stakeholders, would establish an important regulatory framework, enhance consumer and public safety protections, and grant localities and Virginians a voice.”

The AGA estimates that $109 billion is wagered on unregulated machines annually in the U.S., with revenue around $27 billion leading to nearly $9 billion in uncollected tax revenue by the states that do not explicitly ban them.