Social Sportsbook Fliff’s CEO Explains The Product, As Industry Critics Begin To Pile On

The social/sweepstakes sports-focused site is proving popular, but potentially polarizing

5 min

G.K., 20, resides in the Los Angeles area. On a recent Sunday, the college student clicked on an app where he maintains an account and claims to have risked $250 on two NFL games, the same amount on a pair from Major League Baseball, and smaller sums on props.

His activity is legal even though California prohibits sports betting and, of states that allow regulated betting, all but four have set the minimum age at 21.

Under current law, what G.K. does between classes and homework is not considered wagering.

“As a sports management major, I enjoy betting on sports but am not old enough to have accounts with official sportsbooks,” said G.K., who asked this his full name not be disclosed. “Fliff is then my best option.”

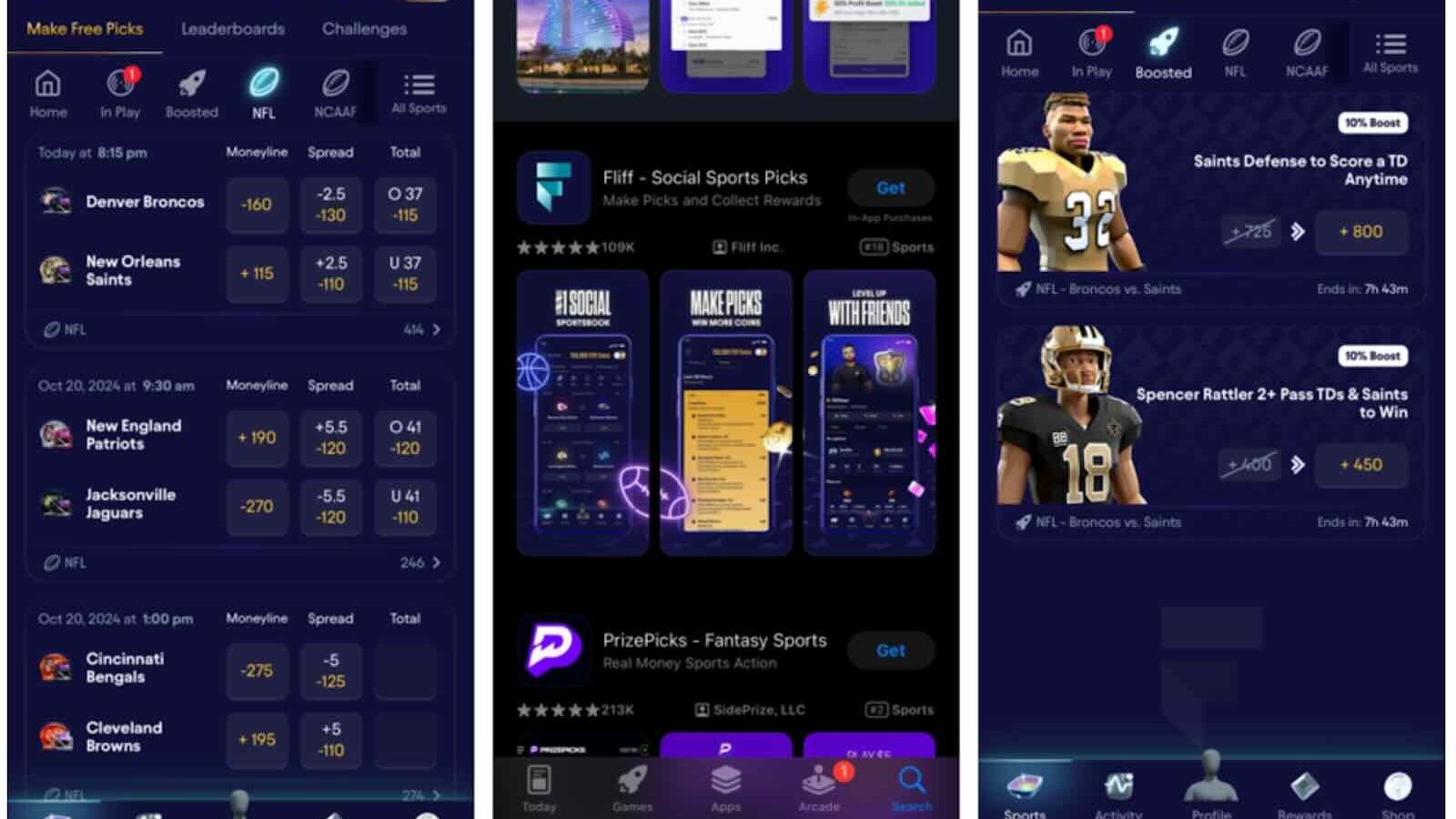

In 2019, the founders of the website Fliff, based in Philadelphia and patronized by G.K., latched on to the hype generated by widespread legalization of sports betting and adopted a format that blends the experience into what is known as a social sportsbook using a sweepstakes model. Actual money is not required to participate — thus, no purchase necessary, meaning there is no “consideration” — and so it does not run afoul of laws in most states.

For the company name, the founders borrowed from a short animated film by a South Park writer in which a bar customer tossed around what he called “fliff money.”

“A social gaming platform for sports fans” is how co-founder and CEO Matt Ricci described Fliff to Casino Reports. It was designed to “capitalize on the engagement of and excitement around sports betting but by building a product we thought would be better suited for the mass market.”

Careful wording

Its consumers tend to be casual sports fans, Ricci said, who may be disinterested in wagering at traditional mobile sportsbooks such as FanDuel and DraftKings. The founders viewed Fliff as an alternative to the sites that draw from the core sports follower segment willing to put its money where its sports mouth was.

Fliff customers, Ricci contends, “are not of high value to a sports betting operator.”

To help draw a distinction, Ricci swaps out the phrase sports betting for “sports predictions” and cash winnings for “prizes.”

Participants can use “Fliff coins,” which is essentially pretend cash, to compete without putting up real money. As the saying goes, it is for entertainment purposes only.

Participants — like G.K. — can also procure Fliff cash as a bonus when purchasing Fliff coins. Winners can redeem Fliff cash for actual money, once their successful “predictions” reach a threshold of USD $50. Employing the sweepstakes model enables Fliff to legally offer both coin and cash options.

Learning curve

Launched in 2020, Fliff grew slowly, Ricci noted, as some consumers were confused by the virtual currency model.

“Having two different currencies [for those] who had previously been into sports betting, they were not understanding how the product was operating,” he said.

In time, its popularity has grown as enthusiastic users share their experiences with acquaintances, which is how G.K. learned of it. What Ricci labeled a “snowball effect” ensued. Fliff has become the dominant preference on the sports-focused side of the social/sweepstakes space.

Fliff’s full product is available in 40 states, with limited access in a few others. Ricci said it would be accessible in more if not for high fraud rates in some states, and the company retreated from those.

California and Texas, the two most populous states where sports betting is not regulated, are home to a high degree of Fliff users.

Ricci asserts that those elements are not necessarily connected, saying the usage should not be framed as Fliff serving as a sports wagering alternative. He observed that some states that permit betting on sports saw an increase in Fliff activity after regulated wagering was approved.

The age question

Fliff could have set the minimum age for participants at 21 to conform with the policies of most states on sports betting, but chose to lower the floor to 18. Ricci justifies allowing upper teens to join in for a couple of reasons:

One, most states that permit daily fantasy sports gambling have given a green light to the 18-to-20 crowd to engage. And in a vast majority of states, persons 18+ are permitted to purchase lottery tickets and bet on horse racing.

Two, he contends that keeping members of the lower age group on Fliff can prevent them from spending more money, or any money at all, at sportsbooks.

“We would rather have them play with us than with some other platform, where they would be [automatically] paying to play,” said Ricci, who claims the average age of a purchaser of Fliff cash is 26.

Tighter restrictions are placed on the younger age bracket regarding the amount they can spend, he added. He did not disclose figures on exactly how much customers risk on sports events, but he said the amounts are much lower than is typically seen at mobile sportsbooks.

“While we do allow them to be playing, we are generally not monetizing those users anyway,” he said.

According to the Social & Promotional Games Association (SPGA), a trade group for the social/sweepstakes category, the vast majority of players who dabble on such sites never make a purchase. For those who jump on the regulated sportsbook sites, depositing money is a necessity.

The SPGA is planning to issue a code of conduct in the coming weeks to articulate the policies and procedures of its members (and some non-members) with respect to age verification, KYC measures, geolocation, and anti-money laundering policies aimed at ensuring a safe and responsible customer experience.

The legality question

While Fliff and others of its ilk stand in the clear legally for now in most states, a gaming and sports betting attorney views their status as in a gray area and predicts it could become more black-or-white as soon as next year.

“I think a storm is brewing,” said Daniel Wallach, who is based in Florida and has become a vocal critic on ‘X’. He noted that VGW, one of the nation’s largest sweepstakes casino operators, is meeting legal headwinds, namely in the form of multiple class-action lawsuits, and its fate could impact similar companies.

Wallach gives props to Fliff for functioning in the sunshine with a known location and being accessible, in contrast to some offshore betting sites with undisclosed locations that are often difficult to reach.

The SPGA underscores the point that “unlicensed” or “unregulated” should not be conflated with “illegal,” arguing that critics from within the gaming industry are simply seeking to stamp out competition. The group notes further that innovation is often driven by products from outside of traditional regulatory structures.

Fliff may wind up facing some resistance from Native American gaming interests in California. On a webinar Wednesday, representatives of the Indian gaming associations in the state and nationwide accused entities such as Fliff with exploiting legal loopholes to make unregulated, untaxed casino and sports betting available to Californians.

“They’re young enough to still smother in the crib, and that’s exactly what we’re going to do,” threatened Victor Rocha, conference chairman of the national association. He said the group will explore assistance from state and federal governments, noting that Michigan dispatched cease-and-desist letters to such companies.

“Anyone who followed the election of 2022 in California on the sports betting propositions should clearly understand that the tribal nations in California have material financial resources to direct to ensure their position is well represented,” commented Richard Schuetz, a former appointee to the California Gambling Control Commission and former Las Vegas casino executive (also a Casino Reports columnist). “Moreover, they can and appear willing to fight this battle on multiple fronts. These include the California legislature, the California Attorney General’s office, the National Indian Gaming Association, all tribal associations, and all tribal lobbying entities, as well as many friends in the U.S. Congress. Collateral damage is also possible here, especially for non-tribal firms that may want to work with tribes in the future. And a good rule in evaluating the tribal nations in California is never, and I mean never, underestimate their financial wherewithal or reach.”

Regarding Fliff and others that open the door to 18-to-20 year olds, Wallach said, “The lower age might be a factor in state agencies looking at this issue more closely.”

Should some states eventually balk at allowing the age group to dive in, it will soon not matter to G.K. His next birthday is his 21st.