23 Assorted Thoughts On DraftKings’ Planned Betting Surcharge, And One Important Poll

Predict what FanDuel will do (or will not do) during next week’s earnings report

8 min

The story on DraftKings’ efforts to pass back the costs in response to Illinois’ recent tax increase on gross sports betting revenue, now a graduated spike from 20% to 40% that would double the gambling firm’s bill in-state, is an absolute powder keg of intrigue.

The story only just began last week when the company revealed the plans in a letter to shareholders, coinciding with its 2024 Q2 Earnings report — the first time the company recorded a profitable quarter, by the way.

The standoff has all sorts of elements of a great controversy, a popcorn-worthy plot: politics, economics, law, public policy, poker playing (are they bluffing?), communications and messaging, human nature, and more.

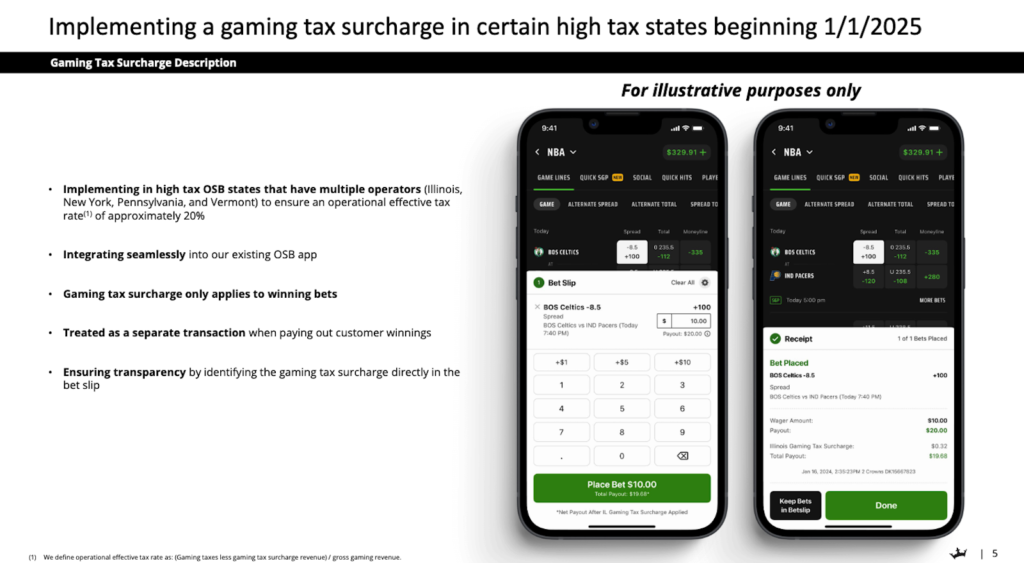

DraftKings did the math on the Illinois tax increase, and ran the numbers in other high-tax jurisdictions including New York (51%), Pennsylvania (36%), and Vermont (51%), then ultimately made a gut check bet on consumer behavior.

The most important plot point ahead impacting the probable course of the DraftKings decision-making is whether or not U.S. online sports betting market co-leader FanDuel decides to follow and apply the same or similar surcharge in certain markets. And we expect to learn what FanDuel’s plan is, if it has one yet, when Flutter holds its Q2 2024 earnings and conference call on Tuesday, Aug. 13 at 4:05 p.m. ET.

Until then, we remain fascinated by all the subplots, considerations, and potential pitfalls of DraftKings’ plan. What follows is a semi-jointed collection of 23 random thoughts, points, ideas, or memes about it. Take the poll now, or better yet, digest all of the below and then register your prediction at the bottom.

Poll: Predicting FanDuel’s Response To DraftKings’ Sports Betting Surcharge

What will FanDuel do in response to DraftKings' surcharge on winning bets in "high tax" jurisdictions?

1. At this point, it sure sounds like DraftKings CEO Jason Robins believes FanDuel will follow its lead. “I think every company has to do what’s best for their own business,” Robins said in the question-and-answer portion of last week’s call with investors. “I think we believe [implementing this surcharge] is what’s best for us. And I would imagine that if that’s our calculus, then others would come to the same conclusion.”

Remember, the company cannot engage in any monopolistic price-fixing scheme and hatch some sort of agreement with its fellow market competitors. The power of suggestion is another story.

2. Implementation of the surcharge is by no means a done deal yet or certain to happen. “And, obviously, there might be other ways, too, that — other ideas for how to implement something like this that might be better than what we came up with,” Robins said. “We thought through this quite a bit, but you never know. So we do have some time between now and Jan. 1, and we’ll see what happens.”

“As of now, I don’t think there would be any reason that we wouldn’t implement it,” he added, “but obviously we’re paying close attention to customer feedback. And if we hear anything that makes us change our mind, we’ll certainly let you know.”

3. So, what kind of customer feedback did DraftKings receive? It’s impossible to know from the outside. Remember, Twitter/X isn’t real life and #GamblingTwitter is a very vocal minority, the opinions of which DraftKings does not weigh much at all into its thinking. Of course the surcharge story did hit the mainstream last week as well, but media sentiment and consumer behavior are different animals.

4. Investors, by and large, don’t love the surcharge idea.

5. Some folks think DraftKings’ idea is a good one and believe that it ultimately will benefit the consumer. Yes, the same consumer who in the short term may in certain states have to eat the 3.2% surcharge on a winning ticket. “Stymieing 50 percent tax rates is going to be better for players, long-term,” one industry source said, adding that some of the margin will go toward product, marketing, and promotions.

6. There may be hurdles or headaches ahead that undermine the surcharge idea. On that point, let’s kick it to Illinois lobbyist Steve Brubaker.

Frankly, I don’t know whether DraftKings or any other operator needs legislative approval to impose this surcharge. But it’s possible they technically do and that this may have have to weave through a statehouse in Illinois, New York, or elsewhere before implementation.

7. DraftKings is ultimately betting on some combination of the quality of its product, loyalty, familiarity, consumer laziness, and/or inertia. The company’s thought is that enough people don’t ditch DraftKings in response to a “nominal” charge, such that the gains will offset any losses in market share.

“For us to be able to be competitive with the illegal market and invest properly in product and customer experience in a state that has a very high tax rate, we feel this is an important step that consumers will ultimately understand,” Robins said. “And if they feel the product and experience is better, then they’d rather pay for that than somewhere else that maybe doesn’t have as strong a product.”

8. Why are we here again? We’re talking about these high tax rates on gross gaming revenue (GGR) in New York (51%), Illinois (graduated up to 40%), Vermont (51%), and Pennsylvania (36%, but promotional deductions help mitigate).

Referring to the 51% tax rate on GGR in New York, “They lobbed that grenade on themselves,” remarked SBC’s Jessica Welman on the iGaming Daily podcast on Tuesday, referring to the bidding process in New York that contributed to the establishment of a nation-high tax rate.

Echoing the sentiment:

9. It’s hard to put the toothpaste back in the tube. But a lot of this obviously is about sending a message to stem off a run on tax rate increases in other jurisdictions.

“I do think that in the absence of us doing something like this, why wouldn’t more states consider it?” Robins said. “It’s not getting passed to their customers, they’re not hearing from their constituents, and we haven’t, in New York, done anything differently, or nobody in the industry has. So I do think that this is something that may make some states reconsider, because now they may be hearing more from their citizens that they don’t like it.”

10. A word about transparency. “Can you just talk about the thought process behind using a surcharge as the mitigation measure as opposed to a more discreet lever?” Goldman Sachs’ Ben Miller asked Robins.

“I know there’s maybe benefit to hiding it,” Robins said. “Because maybe people don’t notice, but I think over the long term customers appreciate transparency and even if they don’t love that, their state implemented a high tax and some of that is being passed along. I think they prefer that to not knowing if it were buried in the pricing or something else.”

11. I think DraftKings is intending mainly to leverage the surcharge as part of a public relations campaign, not so much for balance in books in the high-tax states. If it were more about the latter, they would have used a more discreet mechanism.

12. Well, one more word on transparency.

13. How far will the PR campaign go, if it does proceed on Jan. 1? Is DraftKings going to insert a button to “contact your local lawmaker” right there in the betslip or something? Wouldn’t be shocked.

14. If you want to learn more about the underlying math, here’s some nitty gritty numbers from Alfonso Straffon.

15. Ulterior motives? Some including Brennan Jr. and Straight to the Point’s Steve Ruddock (a Casino Reports contributor) have theorized that part of the idea may be to invite away patrons who are price sensitive, i.e. less likely to be the profitable (for DraftKings), recreational types that the sportsbook prefers.

Taking Robins’ comments at face value, in response to a question about how the surcharge may impact bigger-bankrolled players, while the above theory may be true or at least may be a beneficial side-effect, it doesn’t look to me like part of the calculation.

“I think that players betting multi-leg parlays and things like that are going to be less sensitive, because the payout is already very large,” Robins said. “So, I get that. I hadn’t really thought about how it might affect — I mean, we’re hopeful that our product and the investment we’re making, our customer experience is strong enough that we have players across the spectrum and they view us as being worth maybe paying a few extra cents on a bet.”

16. Will the surcharge somehow escape the GGR tax? That would certainly get the attention of Illinois lawmakers. This interesting topic sprung up on LinkedIn, and while there’s no definitive answer to present at this time, the answer seems likely to be no — the surcharge dollars will likely still count toward GGR that will be subject to taxes.

“Why does it matter how OSBs take money from bettors?” Brubaker said in a conversation with Casino Reports. “Be it through a higher vig, unreasonably priced SGPs, or adding a surcharge. It is all gambling money that is turning into OSB income. There shouldn’t be any other way to look at the surcharge money other than taxable gambling revenue.”

17. Just a comment from Gene Johnson that I enjoyed.

18. And if you somehow missed it, this is/was the best meme from all the surcharge excitement.

19. Nice job by Rush Street Gaming, seizing on a PR opportunity.

20. What about the whattaboutism: How about the various hotel and resort, DoorDash, rideshare fees as seen in other industries? Robins contends that this is basically that.

“I think the important thing is that, if you look at sort of the way it’s typically done in other industries, whether it’d be hotel taxes or even the sales tax that you pay when you buy something at the store, taxis, you name it. It’s typically line-itemed out separately and usually 100 percent passed along to the consumer.”

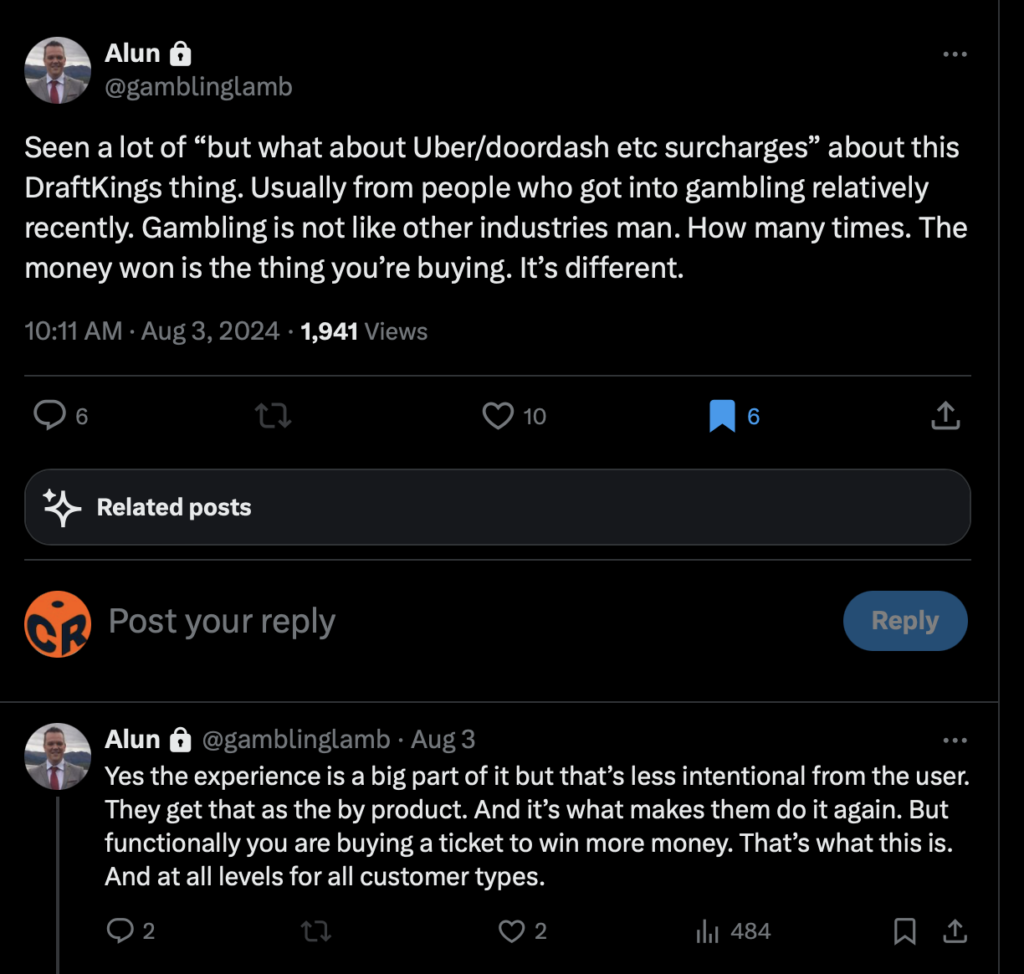

Therefore, bettors in Illinois, New York, and elsewhere in surcharge territory probably will just eat it, the thinking goes. Yet, there is a distinction, as noted by veteran gambling analyst Alun Bowden, who still refuses to make his tweets public, necessitating this screen capture instead:

21. I think one more way to illustrate the difference is this: What if instead of DoorDash applying the “processing fee” or a “double secret delivery fee” or whatever, when the carrier arrived at your door with the food, they first grabbed the cookie you ordered for dessert and took a bite out of it?

Only about 3.2% of the cookie, but still, a reduction on the thing you purchased, effectively.

22. There’s a scenario where FanDuel doesn’t go along with a similar plan, DraftKings notices some material negative impact, and between say NFL playoffs and MLB Opening Day, decides to reverse course.

“But certainly we’ll have to see how that plays out and it’ll be something just like everything, where we look at the data and we decide what we do accordingly,” Robins told analysts. “I do think that if you run the math, it would take quite a bit of top line deterioration to make it not worthwhile from a bottom line perspective. So, I’m optimistic. But we’ll have to see and we’ll have to follow whatever the data and analytics tell us to do.”

What’s messaging at that time?

23. Which brings us back to the beginning: What say you, FanDuel? “Some believe FanDuel would not take an absolute stance in response, but rather could leave room for flexibility in the future,” said Jefferies analyst David Katz, per CDC Gaming Reports. “FanDuel could market against it and gain more share from new customers, irrespective of whether it leads to more EBITDA, which would be negative for DKNG shares,” Katz explained.

It’s also possible that FanDuel punts and then, sometime in early 2025, decides to join DraftKings.

But for all we know, FanDuel may decide to go on offense like Rush Street.

Poll: Predicting FanDuel’s Response To DraftKings’ Sports Betting Surcharge

What will FanDuel do in response to DraftKings' surcharge on winning bets in "high tax" jurisdictions?

Poll will close after Flutter’s Q2 earnings question-and-answer session completes.