DraftKings Tests Elasticity, Raises Antitrust Concerns With Proposed Surcharge On Winning Bets In High-Tax States

Will anyone follow suit and will DK follow through?

5 min

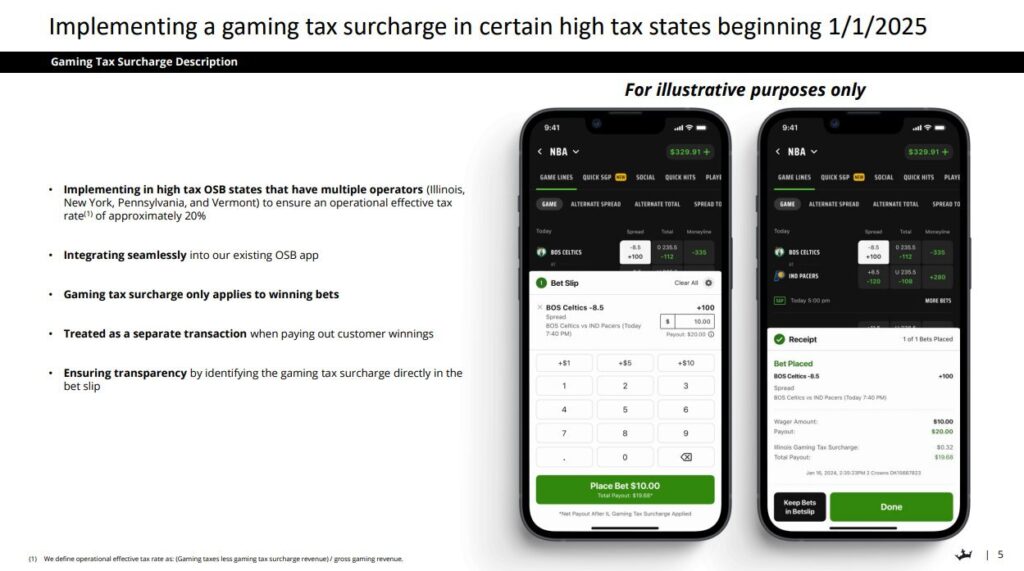

Known for being brash, bold, innovative, confident, and even a bit reckless at times, DFS upstart turned gambling industry and sports betting juggernaut DraftKings unveiled one its greatest gambits yet on Thursday: a proposed surcharge on customers’ winning bets in several U.S. jurisdictions where the state levies a relatively high tax rate.

Widely discussed (and largely reviled) on X on Thursday, here are the essentials:

One framing: DraftKings is looking to protect its profit margins by passing part of a recent tax increase in Illinois (from 20% to 40% on a graduated basis) on to customers, and likewise level-set its own tax bill for elevated rates imposed at the time of market launches in New York (51% on gross gaming revenue), Pennsylvania (36%), and much more recently, in January 2024, Vermont (51%).

As the dust settles, and before this new surcharge actually gets implemented on proposed effective date of Jan. 1, 2025, three key issues emerge:

1) Elasticity: Will DraftKings customers in these jurisdictions just go along with the new pricing enough for gains from the surcharge to offset potential market share losses or customer migrations; or in economic terms, as explored by economist and columnist Richard Scheutz here, how elastic is the price for DraftKings’ product?

2) Potential antitrust issue: Will other sportsbooks, namely FanDuel and perhaps BetMGM, follow? Is there already a deal in place, or might collusion — other operators making the same price increase/surcharge — occur implicitly via copycatting?

3) Intentions: Is DraftKings bluffing here, floating the surcharge as a trial balloon to gauge response, partly in an effort to stem off tax increases in additional jurisdictions, which it has warned may result in increased costs or inferior product offerings to patrons? Will DraftKings really go through with this plan, or quickly back off and leave the memory as a warning shot about what may occur if the overall tax burden across the U.S. becomes too great?

“The DraftKings surcharge will ultimately test the elasticity of demand and price sensitivity exhibited by users,” said Lloyd Danzig, managing partner at Sharp Alpha Advisors, a venture capital firm focusing on the gambling industry. “Recreational customers who psychologically classify deposits as entertainment expenses may not reduce usage due to a real or perceived marginal decrease in long-term payouts, so long as the short-term experience and entertainment value remains unchanged.

“DraftKings shared a screenshot showing a $10 bet at +100 paying $9.68 in winnings rather than $10.00, after the surcharge,” Danzig continued. “That’s the equivalent of shifting the odds from +100 to -103. Assuming a bet at +100 has a 50% chance of winning, the proposed surcharge results in a 1.6% reduction in Expected Value. While this would be critical to a sharp bettor seeking a sustainable edge, it is likely trivial to a customer pursuing a 1000% or 50000% return via same-game parlays. We expect recreational customers to largely absorb these surcharges, demonstrating their entertainment-centric motives and lack of price sensitivity.”

The roaring popularity of same-game parlays, which FanDuel pioneered in the U.S. before DraftKings eventually caught up, probably factors into DraftKings’ belief that customers by and large just want the opportunity to cash some longshots and aren’t terribly price-sensitive. Increased parlay handle nationwide has produced elevated hold rates at the market leading duopoly, pushing it typically to around 10% versus a once standard hold in the 6-7% range.

Yet, there is risk, especially where here DraftKings is potentially adding and specifically labeling the surcharge right there on the receipt that is a winning betslip.

Less optimistic that DraftKings customers in Illinois, New York, Pennsylvania, and Vermont will take the surcharge lying down come 2025 is John Holden JD/Ph.D, associate professor at Indiana University’s Kelley School of Business.

“The idea that a company would impose a tax and be fairly clear that is what it is, instead of simply adjusting pricing to reflect a surcharge, is an interesting approach,” Holden told Casino Reports. “This seems like a risky bet on the American consumer continuing not to be price-sensitive, something that there is some evidence to suggest.”

Some kind of collusion, perhaps

Schuetz also suggests that DraftKings believes the price for its product is inelastic.

But “more likely, they are banking on tacit collusion, which often happens in oligopolistic markets,” he said. “In this type of collusion, all participants match the price leader. We used to see this often in airline markets, and since this is taught in most business schools, the other participants know what to do under the right market conditions.

“They could also be directly colluding with their competitors, which can bring some serious heat over Sherman Act violations,” Schuetz added. “ I would guess that if DraftKings does this and the majority of the market follows, there will be some investigations, and the bigger the oligopoly (the larger the group of conspirers), the higher the probability of getting busted.”

DraftKings and FanDuel, while heated market rivals, also possess plenty of common interests and share certain lawyers, consultants, and lobbyists that have furthered their shared goals across the U.S.

“Will other companies follow suit?” Holden wonders. “If the industry does rally in support of this winner’s tax, I think you could expect a lot more eyes from regulators. The consolidation in the industry is a growing concern and an across the board adoption of a winner’s tax would likely draw increased attention.”

Casino Reports contacted FanDuel representatives Friday morning via email to ask whether it intended to implement the same or similar surcharge, or if the plan was under consideration. FanDuel issued a response of “no comment.”

Plan, or action?

Of course, for now, as the note to shareholders indicates, this is a plan that has not yet been effectuated. There is an entire NFL regular season that could unfold before any Illinois sports bettor covers the portion of DraftKings’ or another firm’s tax bill that it deems untenable or unacceptable.

“This is yet to be implemented, so there is a chance this is simply being floated as a trial balloon,” Holden said. “If that’s the case, I would think there is a good chance it ends up being popped.”

If you think big plans can’t change in a hurry, well, check the past two weeks of odds history in the U.S. presidential race.

For Illinois’ part, it is accustomed to jostling with DraftKings. Back in 2015, then-Attorney General Lisa Madigan issued an opinion declaring daily fantasy sports illegal in the state, yet the companies continued to operate in the state as they disputed the opinion and sought a judicial resolution.

Come the post-PASPA era when states began to legalize sports betting, Illinois did so with a caveat that favored incumbent casino interests in its state, crafting a so-called “penalty box” that would allow Draftkings and FanDuel to operate sportsbooks in the state, but only after a period of 18 months during which patrons would have to register in person for accounts, intended to give a leg up to Rivers Casino and other existing firms.

Of course, the COVID-19 pandemic intervened there, and Gov. J.B. Pritzker issued repeated orders suspending the rule that patrons would have to register in person for sportsbook accounts, effectively negating the advantage conceived in the legislature. Meanwhile, New York was at one time ground zero of the fight for the future of DFS, which found a hostile adversary in former New York State Attorney General Eric Schneiderman.

So in some ways, in Illinois and New York, this is familiar, uneasy territory for DraftKings. Where it goes from here is anyone’s guess. Keep a close eye on FanDuel, and the other eye pointed toward the sky, looking to see if a large orange, black, and green balloon pops.