CFTC To Review Crypto.com Sports Contracts

Government agency’s review could be scuttled, however, with swearing in of new presidential administration Monday

1 min

The Commodities Futures Trading Commission announced Tuesday it has initiated a review of two sports contracts that Crypto.com submitted recently.

In December, Crypto.com launched its sports betting trading platform for U.S.-based users through its app, with Super Bowl LIX its first market offering. It added last week both NFL conference championship games and Monday’s College Football Playoff championship between Ohio State and Notre Dame.

The first contract up for review is what the CFTC calls Crypto.com being an “association participant that is a title holder for the association title event for a given calendar year (Title Event).” The release cites the NFL, NHL, and NCAA as “association participants.”

The second contract the agency will scrutinize involves what appears to be the victory parade that would follow a title-winning team since Crypto.com is an “association participant that is the title holder for an association in a given calendar year on a given date in recognition of the outcome of the Title Event.”

In its release, the CFTC said “the contracts may involve an activity enumerated in CFTC Regulation 40.11(a) and section 5c(c)(5)(C) of the Commodity Exchange Act.” The CFTC announcement also triggers a 90-day review, which could potentially render wagering on those sporting events moot since the CFTC has requested — per regulations — Crypto.com suspend any listing and trading of the contracts.

What regulations are in question?

In reviewing CFTC Regulation 40.11(a), it would appear the agency is within its scope to review the contracts since it potentially could involve gaming that is “unlawful under any state or federal law,” and whether a sporting event can be classified as an “excluded commodity.” The Commission could then determine such transactions to be “contrary to the public interest.”

Section 5c(c)(5)(C) gives the CFTC authority to “prohibit registered entities from listing or making available for clearing or trading certain event contracts that involve particular activities, if the Commission determines that such contracts are contrary to the public interest.”

The wrinkle to the CFTC’s announcement is the impending administration changeover with President-elect Donald Trump scheduled to be sworn in Monday. CFTC Division of Enforcement Director Ian McGinley will depart the agency Friday, while Rostin Behnam will step down as chairman on Monday, creating the possibility the incoming chairman will cancel the review.

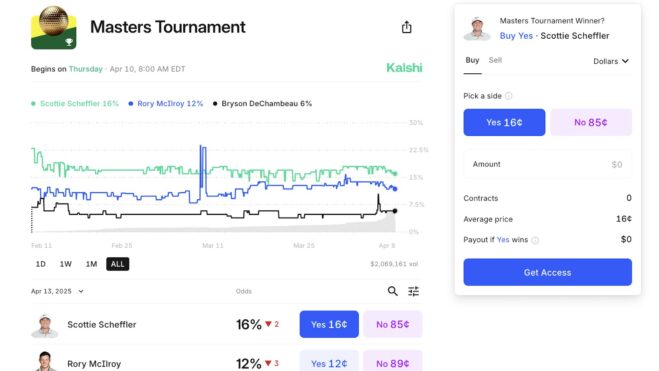

Cryptocurrency with relation to sports betting is still in its very nascent stages. Wyoming is the only current commercial market that allows bettors to fund their accounts via crypto. The rise of presidential prediction markets and its coverage throughout the 2024 election, however, offered a glimpse of what could be a lucrative wagering ecosphere.

Kalshi, which emerged as the top presidential prediction marketplace last year, Monday hired the President-elect’s son Donald Trump Jr. as a “strategic advisor.” The move could be seen as Kalshi potentially seeking leverage should such markets become fully legal in the U.S.