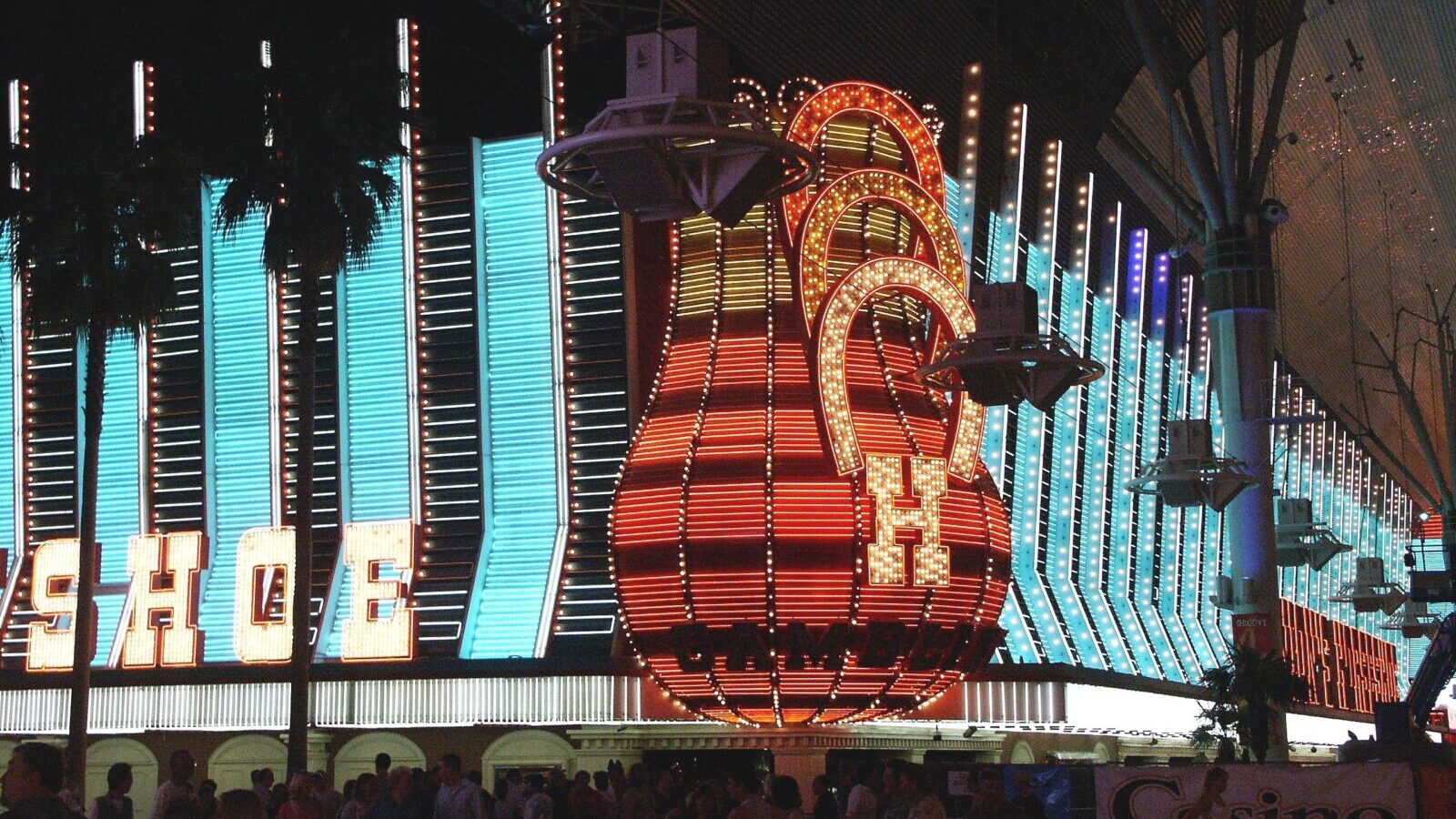

Caesars Unveils Horseshoe Online Casino In Michigan, Using WynnBET License

Company now operates two iGaming platforms in the state, giving it more growth potential

2 min

Caesars Entertainment has officially launched its second online casino brand in Michigan — Horseshoe — under a license acquired from WynnBET. Michigan gamblers now have another option to explore, as Horseshoe joins the previously established Caesars Palace brand in the state.

State regulators allow operators in Michigan to run up to two separate iGaming brands if they have more than one land-based partner, a regulatory quirk that has only been exercised by Caesars and DraftKings. Caesars’ first Michigan platform, the Caesars Palace Online Casino, launched last year. The addition of Horseshoe to the mix is expected to bolster Caesars’ foothold in the state.

Horseshoe’s debut, however, also spells the end of WynnBET’s presence in Michigan. Visitors to the WynnBET Michigan website are now redirected to the Horseshoe platform. In February, Caesars acquired WynnBET’s Michigan license, and the companies finalized the deal in June.

A new chapter for Caesars and WynnBET

The acquisition of WynnBET’s license was a strategic decision, aligning with Wynn Resorts’ broader pullback from the online gambling sector. WynnBET had launched its Michigan online casino at the inception of the state’s iGaming industry in January 2021. Despite some success, particularly in the early stages, WynnBET began scaling back its operations across the U.S. in 2023, leaving Michigan as its last remaining active market.

WynnBET’s Michigan product had generated $175.1 million in lifetime revenue before the brand was retired, ranking eighth in market share out of 15 operators. While a respectable showing, the brand never fully capitalized on Michigan’s lucrative online gambling market and was capturing just 1.4% of the market share by August 2023. In contrast, Caesars Palace held a healthier 6.4% of the Michigan market during the same period.

WynnBET’s exit represents the end of an era for the brand, but for Caesars, it’s an opportunity to build on the foundation left behind. Rather than allowing the WynnBET site to go dormant, Caesars saw value in repurposing the license and launching its Horseshoe brand — an established name in land-based casinos — as an online alternative for Michigan gamblers.

With the addition of Horseshoe, the number of licensed iGaming sites in Michigan remains at 15, ensuring a competitive market environment.

Strategic partnership and market outlook

The transition of the WynnBET license to Caesars was facilitated through a partnership with the Sault Ste. Marie Tribe of Chippewa Indians, which holds the license.

As the only other operator to exercise the multiple-skin option, DraftKings runs its primary DraftKings platform and its subsidiary, Golden Nugget Online Gaming.

Horseshoe’s launch in Michigan is particularly noteworthy as it marks the first state where Caesars is testing Horseshoe as an online casino brand. In states like New Jersey and Pennsylvania, Caesars has opted for different branding strategies, offering Caesars Palace as a standalone casino product, as well as a combined Caesars Sportsbook & Casino platform targeting sports bettors.

Horseshoe, with its strong historical association with land-based casinos, could attract more traditional gamblers. Caesars CFO Eric Hession has expressed optimism about Horseshoe’s potential in Michigan. During a July 2023 investor call, Hession noted that while Horseshoe would likely play a secondary role to Caesars Palace in terms of revenue generation, it is still expected to make a meaningful contribution to Caesars’ overall iGaming revenue in the state.

Caesars unlocks new funding

Caesars, which also recently acquired Australia-based betting tech company ZeroFlucs, is receiving financial support for its upcoming ventures through a fresh influx of funds. In September, the company disclosed that it had sold the intellectual property rights to the World Series of Poker to investment firm NSUS Group Inc. for $500 million. According to a recent SEC filing, Caesars expects to receive the first installment of $250 million by the end of this year.

A significant portion of the funds from the WSOP sale is designated for other uses. Caesars intends to allocate the majority of the proceeds toward paying down secured debt or reinvesting in its business operations. The remaining $250 million from NSUS is due five years after the deal closes.

The SEC filing also informed shareholders that the company’s board had approved a $500 million share buyback program and planned to issue $1 billion in corporate bonds. Caesars clarified that the $500 million amount is not fixed, and the timing of the buyback program will be decided later, taking into account market conditions and other relevant factors.