Undercover Operation Exposes Alleged Money Laundering Through FanDuel

The Flutter-owned sports betting operator FanDuel is embroiled in an investigation that claims money was laundered though the platform.

2 min

An FBI sting operation has shed light on a sophisticated money laundering scheme that allegedly exploited popular sports betting and online casino platform FanDuel and the larger gambling ecosystem. Alex Bogomolny, the suspect at the center of the case, is accused of using FanDuel accounts and other businesses to clean millions of dollars in illicit funds.

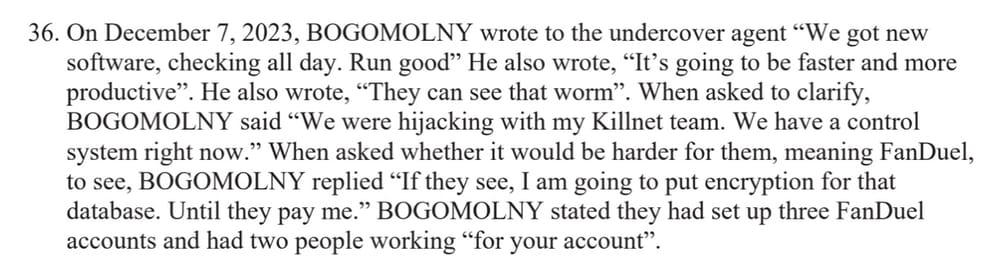

Court documents, unsealed last week and reported by 404 Media, detail how Bogomolny allegedly offered his services to undercover FBI agents posing as criminals seeking to launder money. Text messages reveal Bogomolny boasted of a “BlackSnake Team” capable of handling large sums.

The sting operation began in late 2023. Bogomolny, unaware he was dealing with undercover agents, readily divulged details about his laundering techniques, including the use of casinos, money transfer services, and his FanDuel scheme.

During an undercover meeting, Bogomolny allegedly agreed to launder the agents’ $20,000. Interestingly, he also mentioned a “hacking forum” and later used the username “BlackSnake Team” in a text message. 404 Media stated that there was no information regarding the specific forum but added that a search of Bogomolny’s residence allegedly revealed a password for a top Russian language cybercrime forum, Verified.sc.

A simple setup

The laundering process, according to the media outlet, involved creating FanDuel accounts and then depositing the illicit funds. Bogomolny assured his clients that the money would be gambled, and winnings, appearing legitimate, could be withdrawn.

The complaint details how Bogomolny, who had at least one as-of-yet unidentified conspirator, allegedly used compromised credit cards and online payment accounts to fund the FanDuel accounts. Sometimes, individuals were recruited to open accounts under their own names, with the promise that they would receive some of the laundered money as payment. Once loaded, the funds were withdrawn at casinos or digitally transferred via wire transfer, PayPal, and other payment methods.

Screenshots shared by 404 Media appeared to show accounts with over $2 million in winnings. Bogomolny had allegedly presented the screen grabs to the clients in order to convince them of his capabilities.

The FBI alleges this wasn’t an isolated incident. Bogomolny reportedly claimed his team had been running this scheme “for a long time.” The investigation uncovered a complex web of transactions involving CashApp, PayPal, cryptocurrency transfers, massage parlors suspected to be fronts, and even a hacked gym membership.

It isn’t clear how much money may have been circulating through FanDuel. The investigation into Bogomolny’s activity continues.

FanDuel attempts to squash AML controls

Flutter-owned FanDuel, which has remained silent on the allegations, apparently doesn’t strongly support anti-money laundering (AML) controls. Last October, it petitioned the New York State Gaming Commission to have the regulator’s AML policies dropped. The NYSGC explained in the New York State Register that month, “FanDuel suggested eliminating anti-money-laundering requirements entirely or, in the alternative, eliminating the requirement for an annual compliance statement.”

Money laundering isn’t limited to the gaming space, and financial institutions globally have faced significant fines for non-compliance with AML regulations. In 2021, financial institutions lacking in compliance and due diligence were fined a total of $2.7 billion.

For instance, AmBank received a fine of $700 million in connection with the 1MDB theft and money laundering scandal. Similarly, ABN Amro paid $574 million due to serious shortcomings in its AML processes, including inadequate Know Your Customer checks and failure to report suspicious transactions. Deutsche Bank, Bank of America, and Wells Fargo have also been fined for violating international AML policies.

However, the case involving FanDuel highlights the growing concern of money laundering within the legalized sports betting industry. The U.S. Treasury Department warned of such risks earlier this year, and the FBI alleges Bogomolny’s operation exemplifies those concerns. As a result, introducing more legal sports betting markets in the U.S. and elsewhere could become more complicated and more expensive.