FanDuel Founders Face Motion To Dismiss As Defendants Allege CEO Eccles Mismanaged FanDuel ‘Into The Ground’

Oral argument will occur at the end of this year or early in 2025

4 min

The latest volley in the FanDuel founders case — which pits former CEO Nigel Eccles, alongside dozens of early investors and common shareholders of FanDuel, against an allegedly conflicted board and private equity investors accused of intentionally wiping out those common shareholders in a 2018 merger with PaddyPower Betfair (PPB) — has landed with a bang.

Plaintiffs have until Nov. 14 to oppose the Sept. 16 motion to dismiss the expanded complaint against Shamrock Capital Advisors, KKR, and former board members including former FanDuel CFO-turned-CEO Matt King. King is now the CEO of Fanatics Betting and Gaming and is individually facing a separate charge for fraud in the expanded complaint.

In moving to dismiss causes of action including breach of fiduciary duty, conspiracy, breach of contract, and fraud, among others, attorneys for the defendants write preliminarily, “Plaintiffs’ new allegations and newly cited discovery documents lift the curtain on this case, exposing that their claims are, and always have been, hollow.”

The defendants also write that “after Lead Plaintiff Nigel Eccles mismanaged [FanDuel Ltd.] into the ground, the Director Defendants were forced to step in, pursue a buy-out that Plaintiffs had facilitated, and accept the highest available offer — indeed, the only lifeline that would save FanDuel Ltd. from collapse.”

Except for the one claim against King individually, the case falls under Scottish or “Scots” law; earlier activity in the case determined that the relevant actions and events occurred in Scotland, where FanDuel was headquartered.

The plaintiffs filed their second amended complaint on Aug. 8 after a favorable ruling in May from the New York State Court of Appeals, which held that the plaintiffs did state a valid claim that the director defendants owed the shareholders a fiduciary duty.

The 2018 events

The amended complaint details alleged wrongdoings across 206 pages worth of allegations, following a discovery process in which the parties furnished over 400,000 pages of documents, term sheets, and emails.

Essentially, the plaintiffs claim that the defendants intentionally understated the value of FanDuel’s business and the value of the proposed combined entity with PPB, which became the FanDuel Group, which is today the leading sportsbook in the U.S. valued at over $20 billion.

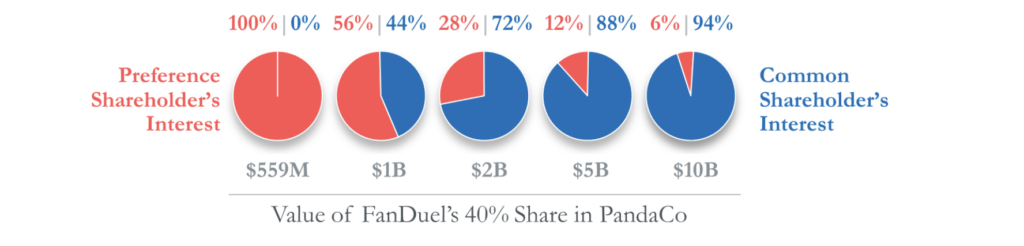

The plaintiffs claim that board members were conflicted when they voted to approve the merger, which gave “preferred” shareholders all of the equity in the merged company, but gave common shareholders nothing. This is was the result of $559 million value assigned to FanDuel, which would equate to 40% of the new company, which also included PPB and cash.

“[Defendants] took the third option, which is, why don’t we just make up a number, and they made that to be $559 million, which just happened to match the preference stack,” said Eccles in an interview (above) with Front Office Sports’ Dan Roberts in August. “Therefore, all of the upside went to the board members who were preference shareholders.”

There are various emails cited in the complaint where senders note that the FanDuel valuation did not contemplate the potential upside of a favorable ruling in the Supreme Court case Murphy v NCAA, which in May 2018 opened the door to legal sports betting across the U.S. Whether or not it was permissible, according to the company’s articles or under applicable law, is another matter of dispute.

The defendants represent that FanDuel at the time was bleeding cash, “poorly managed,” and desperate for a lifeline, or in other words, had no choice but to take the offer.

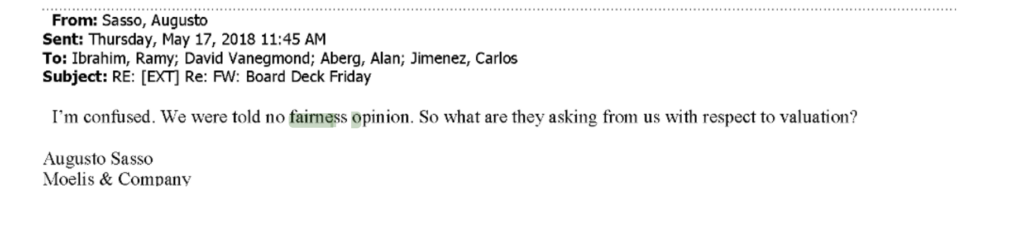

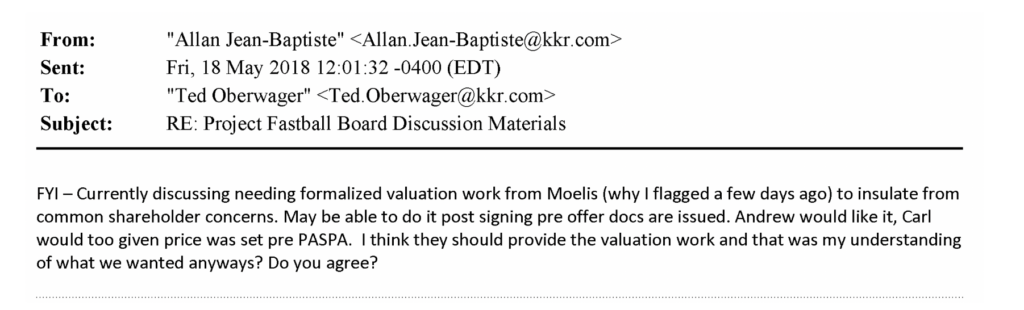

Yet, before and after the Murphy decision came down, communications show questions from stakeholders about whether an independent valuation should be conducted; other communications seemed to acknowledge that the valuation felt low; and communications post-Murphy expressed that FanDuel was worth a lot more than $559 million. King and others were also careful to not discuss the valuation in writing, rather doing so “live.”

Part of the defendants’ contention, however, is that the FanDuel articles did not expressly require a “fairness opinion” or independent valuation, which is a process intended to confirm that all the financials of a deal look fair and reasonable.

From the complaint:

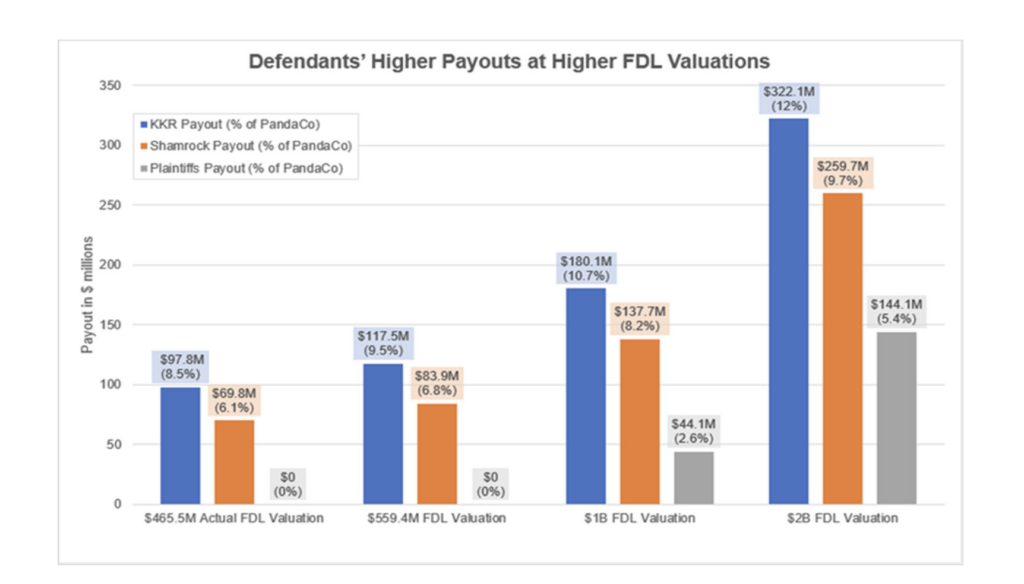

The defendants address these allegations, in part, writing that “Plaintiffs’ new allegations prove the Director Defendants were aligned with common shareholders because they held far more common shares than all Plaintiffs combined. … They thus had every incentive to obtain the highest possible valuation for FDL’s shares.”

And as to the claim of breach of fiduciary duty, defendants write in part:

At a basic level, these claims fail because any “limited fiduciary duties” here, were not to craft the perfect deal (as Plaintiffs assume), but merely to do what the Articles prescribed. Plaintiffs’ breach allegations fall into three main buckets concerning the legitimacy, procedural fairness, and substantive fairness of the valuation of FDL’s shares in PandaCo. ¶ 485. That valuation was legitimate — indeed, presumptively adequate under Scots law — because it resulted from arms-length negotiations, as Plaintiffs do not meaningfully dispute. Infra II.A. It was procedurally fair because, Plaintiffs admit, the Articles did “not expressly require” any further safeguards. NYSCEF 139 at 54; infra II.B.1. And it was substantively fair, reflecting the highest offer received and a price other independent parties accepted for PandaCo shares. Infra II.B.2. These claims should be dismissed.

Flipside on the upside

Now consider this pair of charts, the first from the complaint, the second from the motion to dismiss.

From the complaint, illustrating how the value assigned to FanDuel at the time of the 2018 merger would impact equity ownership for preferred and common shareholders in the new company:

From the motion to dismiss:

Later, only 2½ years after the companies merged, Flutter Entertainment secured another 37% of FanDuel Group, purchasing the shares from the preferred shareholders for $4.2 billion in a deal that assigned a value of $11.2 billion to FanDuel.

Which begs the question, which upside did defendants have their sights set on, and on what horizon of time?

The motion to dismiss also notes that, “Had Murphy actually increased valuations overnight by billions of dollars (as Plaintiffs assume), some investor would have offered FanDuel more — yet none did.”

Whether or not this is true, or if management had represented outwardly that offers were even still welcome as the closing approached just three weeks later, is unclear.

What’s next

This is a complex and consequential case. The defendants’ reply brief to the founders’ opposition will be due on Dec. 19, and around that date or shortly thereafter, the parties will appear for oral argument in New York Supreme Court before Justice Andrea Masley.

A decision on the motion will not come until 2025.

If the motion is granted — and I’m not about to handicap that one, though I wouldn’t bet on yes — there are likely to be a good number of depositions occurring throughout the year as the case marches on and FanDuel’s present valuation climbs.