US Sports Betting Data — Market Share Stats By Brand, Gross Gaming Revenue, Parlay Handle & Hold

Regularly updated U.S. sports betting market charts, insights, and trends

7 min

If you’re seeking data and statistics to tell the story of the regulated U.S. sports betting market, you have come to the right place and right page. Our team of journalists and analysts has been studying the regulated market since its inception. With this live database here, built upon state agency filings, we will identify which operators are generating what revenues, state taxes generated in each jurisdiction, how parlay wagering has come to dominate the market, and more.

The charts and statistics below are presented by Casino Reports in collaboration with independent analyst Alfonso Straffon, a longtime industry observer, former sports trader, and equities analyst at Deutsche Bank. The charts will be updated on a monthly basis, on or about the third Thursday of each month, to reflect the latest state filing data.

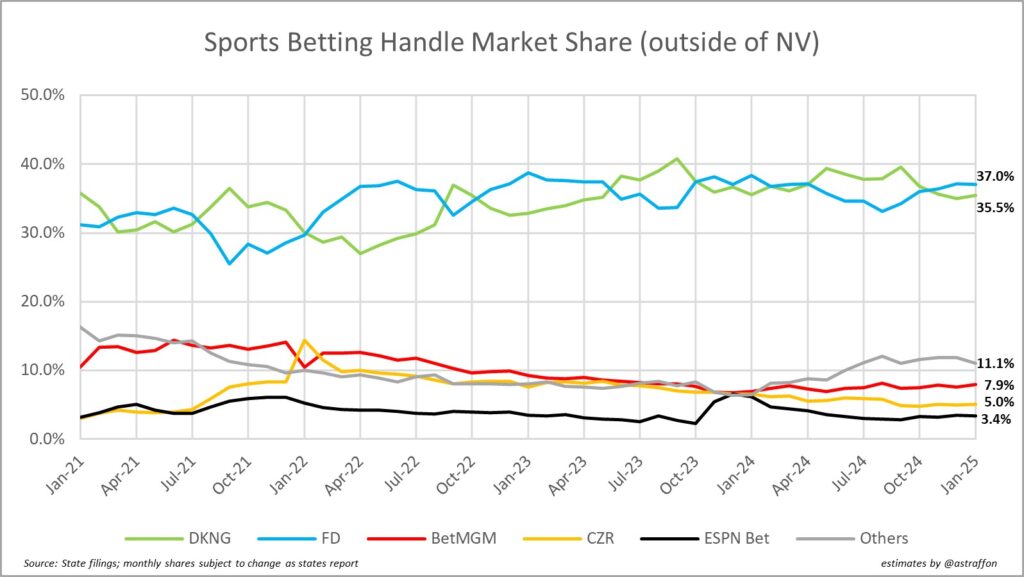

1. Sports betting handle market share (January 2021 to present)

Key Insights

- FanDuel Sportsbook reclaimed the handle crown from DraftKings with a 1.8% advantage in November 2024 and then in December extended it. Through the first month of 2025, it’s FanDuel on top by a margin of 1.5% at 37.0 to 35.5%.

- Dating back to January 2021 (and earlier even), the duopoly of FanDuel Sportsbook and DraftKings Sportsbook have hovered between approximately 30 and 40% — apiece — for market share of the nationwide regulated sports betting handle, i.e., dollars wagered/risked by bettors (irrespective of wins and losses).

- That combined market share has equated to nearly 75% of the dollars wagered in the regulated U.S. market, give or take depending on the month or season.

- BetMGM, Caesars, and ESPN Bet comprise the second tier; that category has oscillated between about 2% and 11% apiece of the national market share.

- Check out the positive inflection in the “Others” category around the start of 2024. That is a reflection of (1) the entry of bet365 into six additional states (11 total) within the past year, and (2) gains by Fanatics since taking over PointsBet.

Notes: The yellow spike in January 2022 for Caesars reflects an auspicious, advertisement-and bonus-fueled start in New York state, coinciding with the NFL playoffs. Unfortunately for Caesars, the momentum did not last. However, Caesars’ share has held steady in the 6-7% range for both sports betting and the more lucrative iCasino sector.

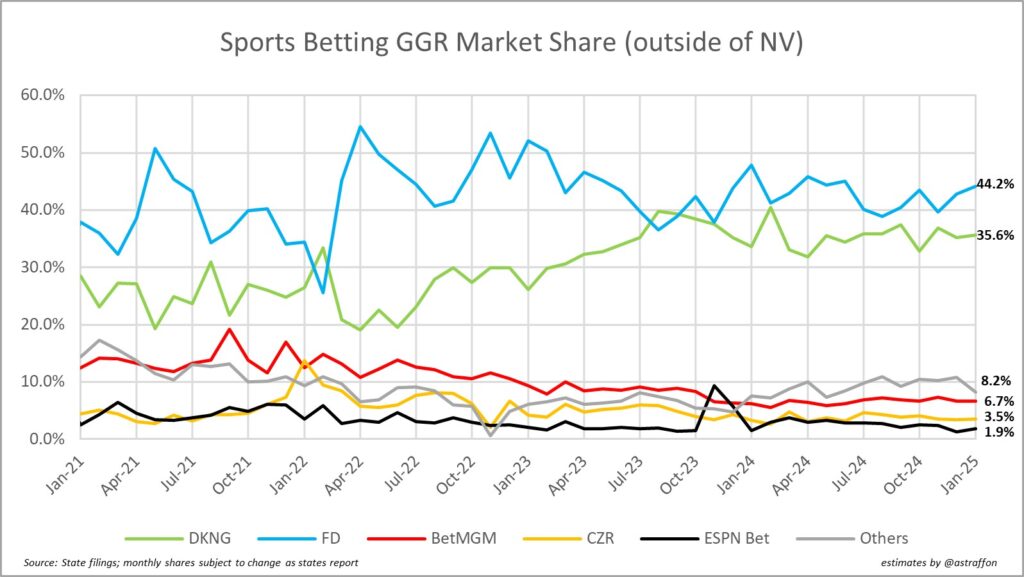

2. Sports betting market share by gross gaming revenue (GGR) (January 2021 to present)

Key Insights

- Notice the blue bar for FanDuel on top here with 44.2% of national gross gaming revenue for the U.S. regulated market; this is against a leading handle market share on handle at 37%, according to the estimates.

- Meanwhile, DraftKings, which took a back seat to FanDuel in Sept. 2023, grabs a 35.6% share of GGR against a nearly identical 35.5% share of handle.

- This dichotomy is mostly a result of FanDuel’s higher mixture of parlay bets and greater hold percentage.

- FanDuel’s parent company Flutter believes that it possesses superior abilities and systems for pricing and risk-management and an overall more effective parlay engine.

Notes: We will continue to monitor ESPN Bet, which is battling in a make-or-break stretch for its PENN Interactive-controlled brand. Likewise, Hard Rock Bet, a well-financed Seminole Tribe-backed product, will leverage its monopoly position in Florida for gains across the country. Figures from Florida do not get reported and therefore are unknown publicly.

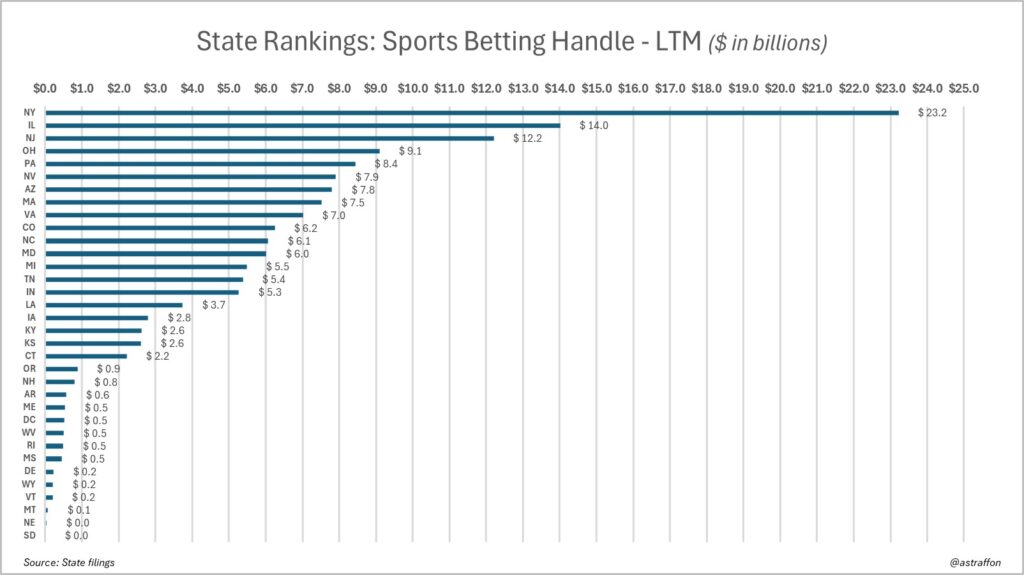

3. Sports betting handle by state, last twelve months (LTM) (2025)

Key Insights:

- That’s a whopping $23.2 billion wagered at New York over the last twelve months; New York’s nine regulated sportsbooks have handled more on average per month (about $1.89 billion) than more than a dozen of the other states’ totals LTM.

- That’s also not terribly surprising given the population of New York and its relatively high per capita income, buoyed by zip codes around New York City, Long Island, and Westchester.

- Oregon and New Hampshire — both states where DraftKings owns a sportsbook monopoly — did challenge for $1 billion handle for 2024 but both fell a bit short at $900 million and $800 million, respectively.

Notes: Mississippi regulators and lawmakers have repeatedly flirted with authorizing online sports betting (and again in March 2025) but as of present, it remains a state with on-premises betting at casinos only.

If or when Texas and California join the ranks of the regulated U.S. sports betting states, something that Las Vegas Sands is determined to make happen (at least in Texas, based on spending), it will be interesting to see how the top of the chart shakes out.

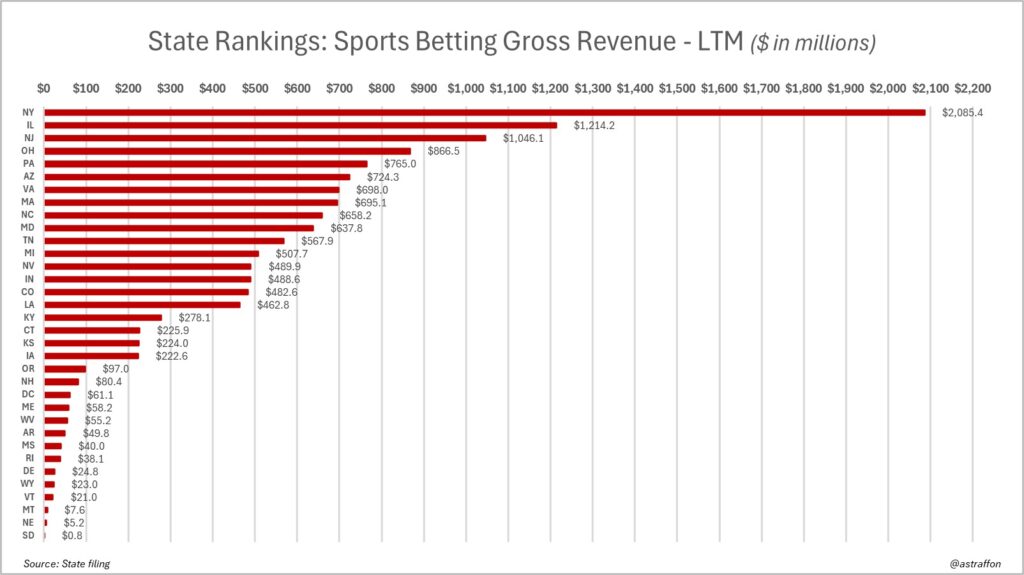

4. Sports betting gross revenue by state, LTM through (2025)

Key Insights:

- Operators are generating large sums in New York, but also had to pay a $25 million up-front licensing fee for the privilege of doing business in the state; New York also levies a nation-leading 51% tax on the GGR generated by its authorized sportsbooks (tied with Rhode Island and Vermont).

- Do not conflate gross revenue with net revenue.

- North Carolina is a regulated sports betting newcomer, having launched its online market in January 2024 to industry and consumer fanfare; it’s early, but after one year, NC’s GGR has climbed past Michigan and into the top ten.

- Illinois, to date, had been one of the more lucrative states for operators. In June 2024, however, Gov. J.B. Prizker signed into law a new state budget that instituted a new progressive tax scheme effective July 1, 2024.

Notes: The law raises the privilege tax on a licensee’s annual adjusted gross sports wagering receipts (AGSWR) to the following rates:

- 20% of annual AGSWR up to and including $30 million;

- 25% of annual AGSWR in excess of $30 million but not to exceed $50 million;

- 30% of annual AGSWR in excess of $50 million but not to exceed $100 million;

- 35% of annual AGSWR in excess of $100 million but not to exceed $200 million;

- 40% of annual AGSWR in excess of $200 million.

The 40% tax will be felt only by DraftKings and FanDuel, which may have been part of the intent of the tax structure modification. The other market participants, barring a surge in revenue, will not reach the thresholds subjecting them to the higher rates.

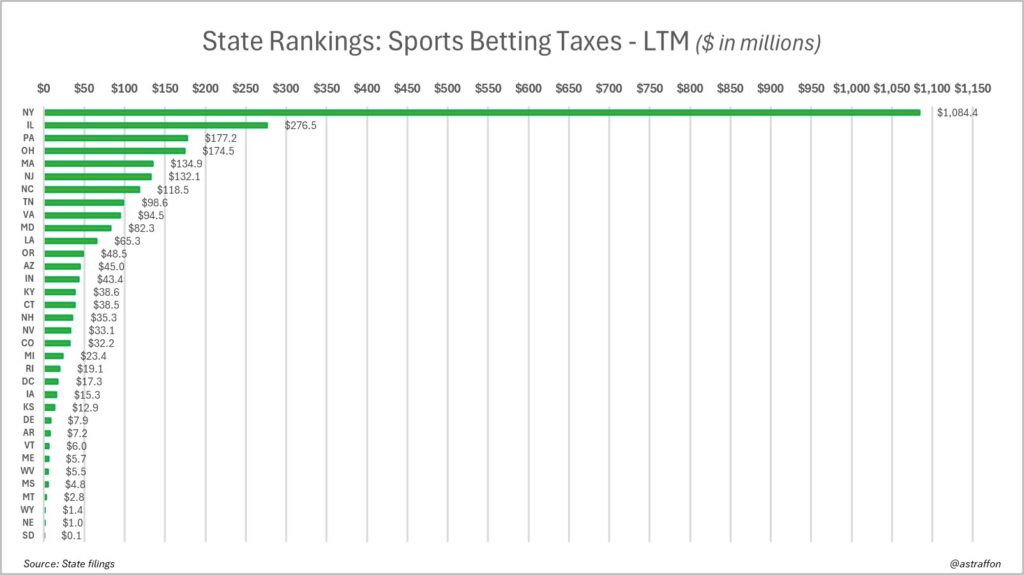

5. Sports betting taxes generated by state, LTM through (2025)

Key Insights:

- Similar to the tax structure modification in Illinois (see above), which has resulted in Illinois jumping into second place here at $276.5 million.

- New York has collected by far the most tax revenue from sports betting with its 51% tax rate on GGR, good for $1.08 billion for twelve months spanning Feb. 2024 through Jan. 2025.

- Effective June 2023, Ohio raised its tax rate on operator GGR from 10% as established at the time of legalization to 20%; so consider that Ohio’s haul would be roughly halved and slide alongside Maryland but for the adjustment.

- Pennsylvania also sits on the higher end of the scale with its 36% rate on operator GGR, a rate that was established at the time of sports betting legalization in the state; at present, PA generated $177.2 million over the LTM, third only to New York and Illinois.

Notes: Illinois’ shift from 15% to a progressive structure may have ripple effects in other states, with lawmakers potentially developing an appetite to turn up the dial on operators. An assemblyman in New Jersey did propose such a bill that would raise the rates on sports betting and iGaming GGR from the 12-15% range to 30% for both. That bill did not gain a co-sponsor in 2024 and would face strong opposition from the casino lobby in the state, but it’s one to watch. Similar efforts are now underway in multiple jurisdictions including Indiana.

Meanwhile, Illinois definitely did trigger a response from the operator side — DraftKings — which in August 2024, coinciding with its third-quarter earnings report, floated a plan to pass the elevated Illinois tax back to the bettor as a surcharge on winning bets. To say the idea was roundly rejected and panned would be putting it mildly. But it took until FanDuel (Flutter) during its own earnings call two weeks later said it absolutely would not follow DraftKings’ lead for DK to publicly abandon the idea and try to save face. Still, DraftKings’ CEO Jason Robins has said the company will consider any and all ideas to protect its margins. But back to the drawing board in Illinois.

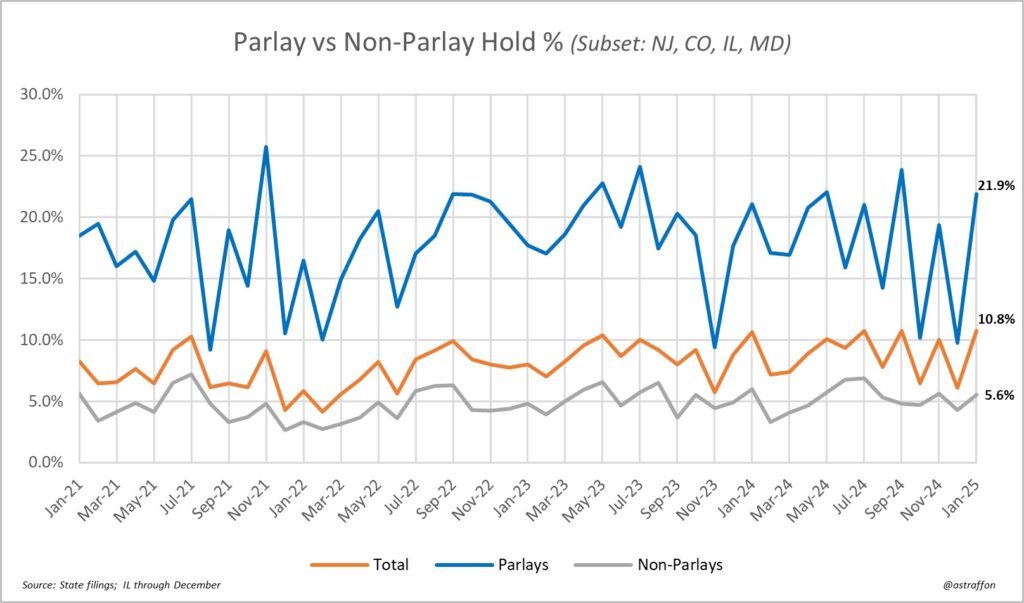

6. Parlay hold % versus non-parlay hold (January 2021 to present)

Key Insights:

- The overall, long-term trend for hold percentage at U.S. regulated sportsbooks is upward. This is due to a variety of factors, including customer adoption and familiarity with SGP wagers, improvements in operator pricing, and operator emphasis on serving up these higher-margin (in its favor) offerings.

- This chart contemplates the betting activity in New Jersey, Colorado, Illinois, and Maryland only (though a pretty nice sample considering the overall volume in these states); the data reporting into granular bet kinds like parlays, above, is more robust and transparent in some states than in others.

- The highest we have observed the parlay hold percentage is approximately 26% in November 2021, which then sharply turned in the other direction in the ensuing months.

- For the most part, the hold percentage on parlay bets and non-parlay bets is correlated, i.e., when one goes up or down, usually but not always the other does, too.

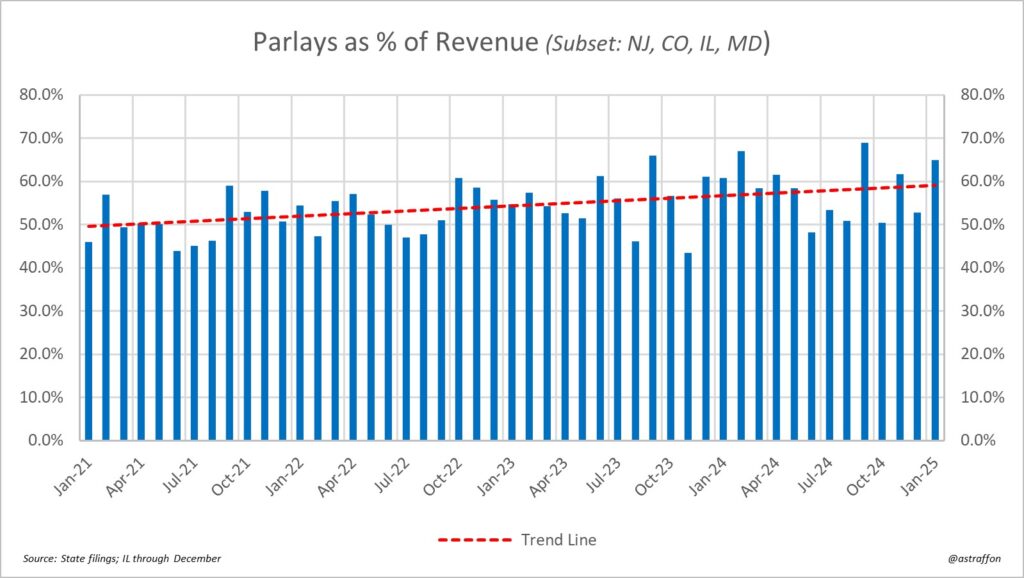

7. Parlay betting revenue’s percentage of overall betting revenue (January 2021 to present)

Key Insights

- The percentage of revenue derived from parlay bets spiked to 65% for Jan. 2025 as the trendline remains angled upwards.

- While the sample is indeed a subset of the regulated market nationally, the four states supplying this data are qualitatively a good, broad, and diverse sample.

- How high can the figures go here? We shall see as it’s probably only limited by ingenuity. For example, how can parlays get folded into live betting? Already some sportsbooks do offer the ability to make in-game SGPs.

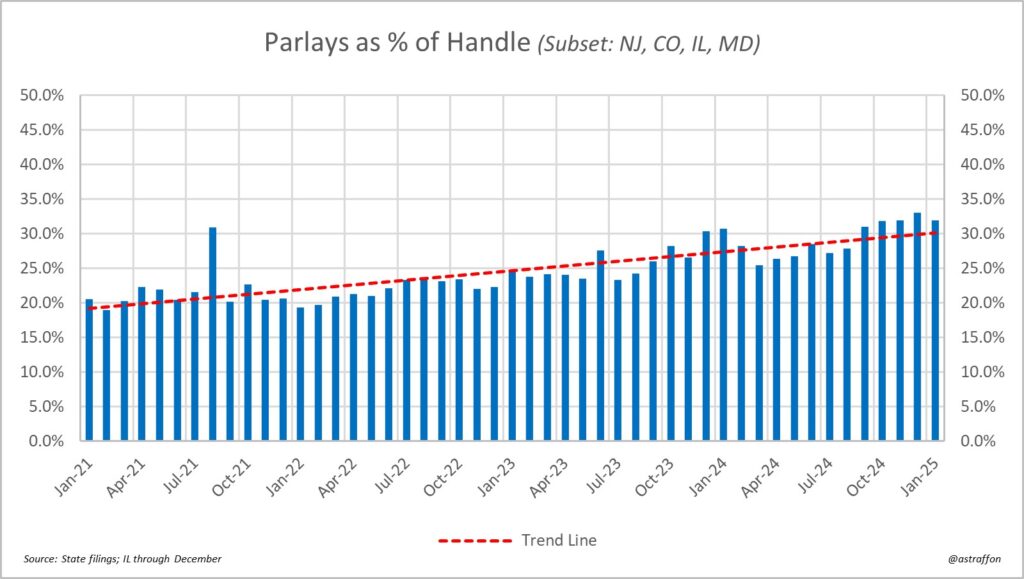

8. Parlay betting as a percentage of overall handle (January 2021 to present)

Key Insights

- Dating back almost four years, this number has grown 10% in four years from around 20% of overall handle to 35% for the month of December 2024.

- The ceiling here isn’t limitless, as long as there are VIPs in the regulated market making large straight wagers on football and basketball.

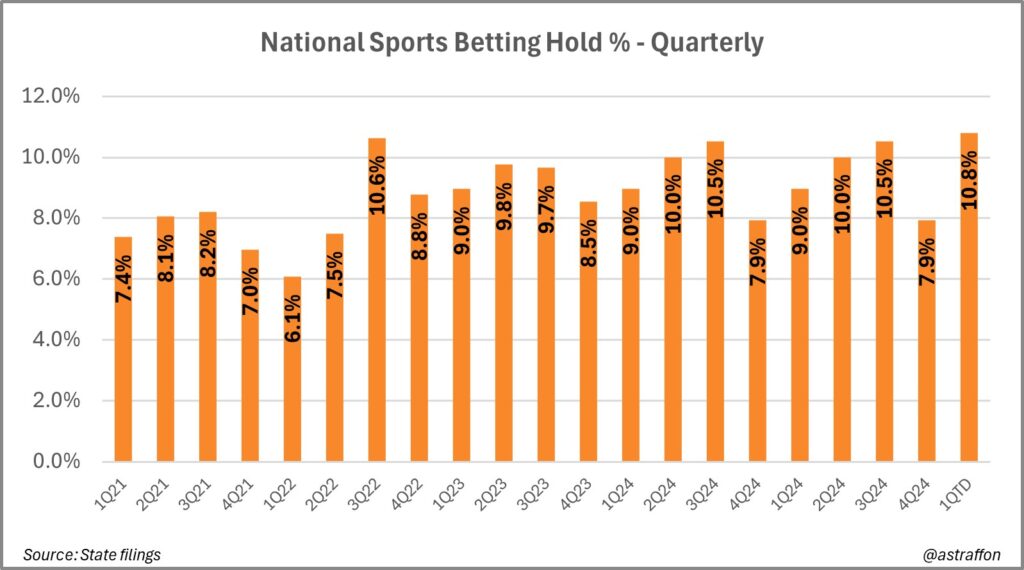

9. National sports betting hold percentage on quarterly basis (January 2021 to present)

Key insights:

- Analysts deal in quarters, not months, so this chart is for them.

- In October and December 2024, the Q4 figure dropped to 7.9% on the back of “customer-friendly” NFL results, i.e., lots of favorites covering. Booking sports can be a volatile business, even in the era of parlays.

- The quarterly handle has reached or exceeded 10% three times to date: 3Q22 at 10.6%, 2Q24 at 10%, and 3Q24 to date at 10.5%.

- If you’re going to bet on which way this number is going, it probably would be wise to bet the over on 10% for future quarters.

- Historically, pre-PASPA when Nevada was the main vein for regulated betting in the U.S, and parlays were given far less emphasis, this number lived closer to 5% than 10%.

Please go here to visit our other database: US Online Casino Data — Market Share By Brand, Gross Gaming Revenue Stats, And Taxation