Spotlight On Fanatics: Sports Betting Market Share Continues To Ascend

Fanatics is up to a 6.8% handle market share in select states and 5.4% for GGR

1 min

Alongside ESPN Bet, one of the more closely watched and well-financed challenger brands in the regulated U.S. sports betting space is Fanatics Sportsbook.

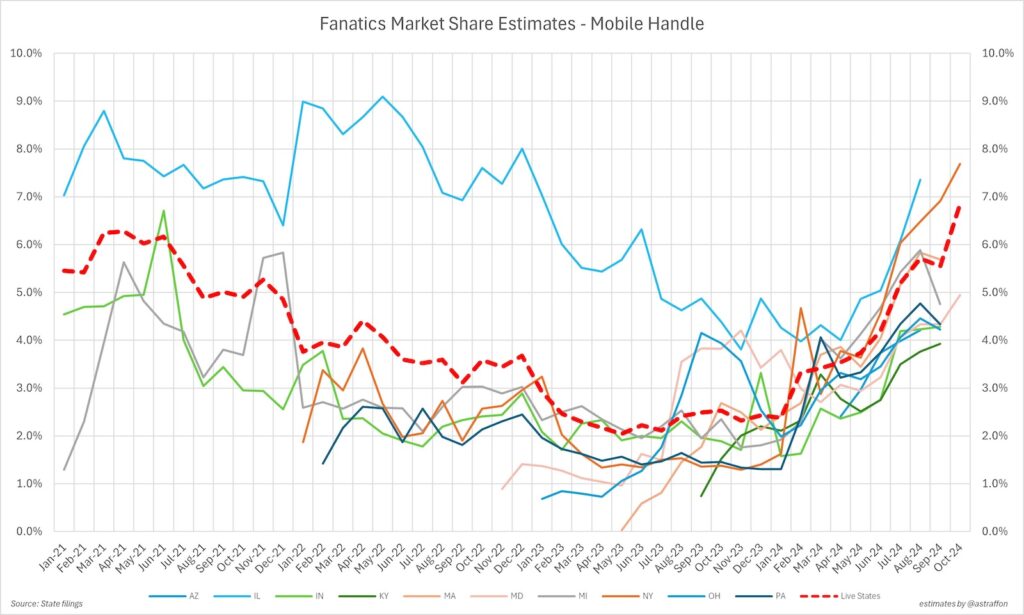

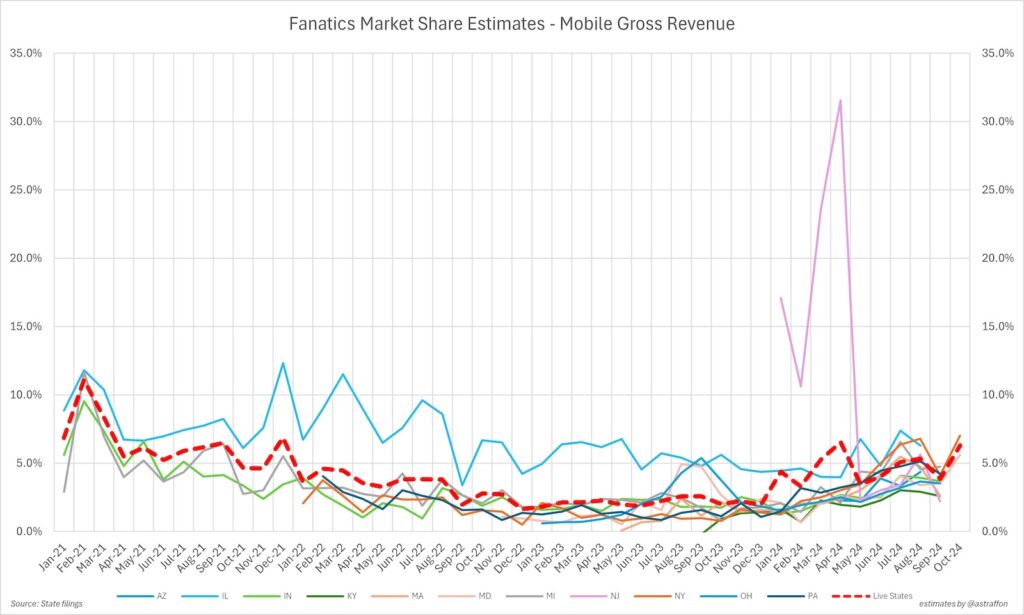

Today, it is time to take another look at the latest sports betting industry stats provided by independent analyst Alfonso Straffon, a longtime industry observer, former sports trader, and equities analyst at Deutsche Bank (click to enlarge):

That huge spike in April 2024 represents the voluminous betting activity of a New Jersey-based VIP, who had migrated his play from DraftKings to Fanatics, at least for that period. The individual is/was a client of DraftKings-turned-Fanatics VIP executive Michael Hermalyn, whose movements and non-compete agreements have been explored in a legal squabble between the two, which upon last check appears to be headed toward some negotiated resolution.

Setting that aside, the underlying trendline the numbers convey is fairly steady, showing incremental market share and gross revenue growth in a majority of states where its sportsbook is live.

- Fanatics is up to a 6.8% handle market share in such states and 5.4% for GGR;

- For perspective, at last count, FanDuel checked in at 35.6% and 42.2%;

- DraftKings is at 39.4% and 36.8%, respectively.

By way of methodology, we are using a subset of states that authorize mobile sports betting, and where state regulators provide monthly results by identifiable operator. Currently there are 20 such states (AR, AZ, CT, DC, DE, IA, IL, IN, KS, KY, MA, MD, ME, MI, NH, NJ, OH, OR, PA, WY), and 21 (former 20 plus NJ) states that provide operator splits for handle and gross revenue, respectively.

In these charts, “live total” represents Fanatics’ aggregate share across the above 20 states from the moment in which they are live, even though the chart is not showing a few states in which Fanatics is live. (This is simply for viewing clarity.) For example, “handle” is not showing the line for CT, DC, WY, KS, or IA, but the “live states” market share does include it. Also note, the further out dates for Fanatics reflect market shares obtained by PointsBet, which Fanatics acquired in October 2023 in a transaction that closed in April 2024.

As for the underlying forces driving the upward shift: One factor is that Fanatics may be extending promotional bets a bit more generously than its peers right now. This would have the effect of inflating handle and GGR market shares. Advertising and product enhancements may be factors, though that is difficult to parse out. It is also reasonably likely that some VIP activity is driving the growth.

Fanatics certainly has aspirations of separating from the (distant) trailing back behind the FanKings duopoly, with BetMGM and Caesars. Although there’s still a ways to go, the arrow is up, so we’ll see if the trend holds in the months ahead.