FBI Raids Home Of CEO Of Cryptocurrency Prediction Platform Polymarket

The reason for the raid isn’t clear, although Polymarket claims it was retaliatory

2 min

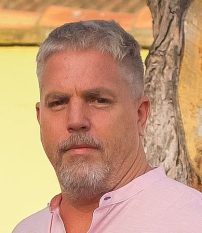

In the early hours of the morning on Wednesday, FBI agents conducted a search of Shayne Coplan’s New York City apartment. Coplan is the founder and CEO of Polymarket, one of the most widely used cryptocurrency-based prediction markets in the world, known for hosting high-stakes betting and for its innovative approach to decentralized finance.

According to sources familiar with the incident, numerous FBI agents entered Coplan’s apartment at approximately 6 a.m., though it remains unclear what the agents sought or whether Coplan and Polymarket are the central targets of an investigation. Coplan was reportedly present at the time of the raid.

Polymarket has gained significant traction since its inception, especially during recent high-profile events like the U.S. presidential election. The platform allows users to wager funds on various outcomes, ranging from political elections to sports results, using cryptocurrency.

While prediction markets in the U.S. have long operated in a gray area due to gambling and regulatory laws, Polymarket has managed to gain support from prominent investors, including Peter Thiel’s Founders Fund, which contributed to the company’s reported $80 million in venture capital backing.

The platform has increasingly drawn attention from international traders, including one prominent French investor who reportedly earned nearly $50 million on Polymarket’s platform during the recent election.

Alleged political retribution

In response to Wednesday’s raid, a Polymarket spokesperson issued a statement expressing concerns about political motives behind the FBI’s actions. The spokesperson suggested that the raid may represent “political retribution” by the outgoing administration against Polymarket, following the platform’s accurate predictions regarding last week’s election.

Polymarket CEO Coplan said in a statement that it was “grand political theater at its worst.”

Polymarket has been accused of paying social media influencers ahead of the U.S. elections. Bloomberg reported that Armand Saramount, Polymarket’s senior director of growth, paid the influencers to promote election betting.

In addition, Polymarket also recently settled with the Commodity Futures Trading Commission, paying $1.47 million to close a complaint that it was operating illegally.

Prediction markets like Polymarket and Kalshi have faced numerous legal hurdles. In the lead-up to the presidential election, Kalshi faced legal restrictions preventing it from offering political betting in several U.S. states.

However, a judge later overturned the ban, arguing that the company’s markets operate within a unique regulatory space due to their use of cryptocurrency and blockchain technology. The court ruling was a substantial victory for prediction markets, but it also underscored the regulatory uncertainty surrounding decentralized betting platforms and set the stage for heightened scrutiny by both U.S. and international regulators.

France has also recently launched an investigation into Polymarket, probing whether the company’s operations align with its domestic gambling and financial compliance laws. French authorities were prompted to initiate the inquiry following revelations about a high-stakes wager placed by a French national.

The trader, who reportedly invested $30 million on Polymarket in a single bet on the outcome of the U.S. presidential election, shed light on the scale of high-risk international participation on the platform. The inquiry will assess Polymarket’s compliance with French law, as well as the nature of its transactions and protections for French users.

An altered state of betting

Prediction markets like Polymarket operate at the intersection of finance, technology, and the law. As decentralized platforms powered by cryptocurrency, they function differently from traditional gambling sites.

Prediction markets aggregate information by allowing users to “bet” on outcomes they believe to be accurate, creating what some experts view as a more efficient form of public opinion polling. However, this unique business model has raised questions about regulatory oversight, particularly concerning fraud prevention, user protections, and the legal definitions of gambling.

Analysts note that prediction markets have historically encountered legal resistance in the United States, where online gambling faces stringent restrictions. Polymarket’s usage of blockchain technology to facilitate bets may push existing regulatory boundaries, as digital tokens on decentralized markets challenge traditional categorizations of online betting, investment, and securities trading.

Despite these challenges, Polymarket’s rise reflects a growing interest in alternative forms of betting and data-driven market predictions. As the company attempts to grow and seek further venture capital, Polymarket’s management has emphasized its commitment to transparent operations and compliance with applicable laws.